- FRM Part 2

- Credit Risk Measurement & ManagementCR

- CR 1 Fundamentals of Credit Risk

CR 1 Fundamentals of Credit Risk

Instructor Micky Midha

Updated On Learning Objectives

- Define credit risk and explain how it arises using examples.

- Explain the distinctions between insolvency, default, and bankruptcy.

- Identify and describe transactions that generate credit risk.

- Describe the entities that are exposed to credit risk and explain circumstances under which exposure occurs.

- Discuss the motivations for managing or taking on credit risk.

- Video Lecture

- |

- PDFs

- |

- List of chapters

Chapter Contents

- Introduction To Credit And Credit Risk

- Some Examples And Sources Of Credit Risk

- Insolvency, Default And Bankruptcy

- Transactions Generating Credit Risk

- Who Is Exposed To Credit Risk ?

- Who Is Exposed To Credit Risk ? Financial Institutions

- Who Is Exposed To Credit Risk ? Corporates

- Who Is Exposed To Credit Risk ? Individuals

- Motivations For Managing Credit Risk

Introduction To Credit And Credit Risk

- The word credit derives from the ancient Latin word credere, which means “to entrust” or “to believe”. In finance, credit refers to a contractual agreement in which one party (borrower/obligor) receives something (typically good or service) of value now from another party (lender/obligee) and agrees to repay later, generally with interest, according to the terms and conditions of the agreement made between the party lending the funds and the party borrowing the funds.

- Entities tasked with fulfilling an obligation are referred to as “obligors”. These obligations often constitute a legal liability through contracts between counterparties for payment or performance. It is important to note that, from a legal perspective, a variety of contractual obligations may not necessarily be documented in writing; verbal agreements can also hold legal weight in many jurisdictions.

- Correspondingly, credit risk is the probability of incurring a financial loss when a counterparty fails to fulfill its financial obligations. This risk is prevalent in transactions where the obligor, the involved party, may potentially default on payments as agreed, either due to incapacity or lack of willingness to comply with the terms in a timely manner.

Some Examples And Sources Of Credit Risk

- Inability to Pay Financial Obligations :

- Obligors may face credit risk when they are unable to meet their financial obligations.For instance, a company that borrows for rapid expansion might struggle to repay the lender due to insufficient cash flows.

- Obsolescence or Decline in Revenues:

- Companies may experience credit risk if their products or services become obsolete or if revenues no longer cover operating and financing costs.

- Default Due to Insufficient Funds :

- When a company lacks funds to meet scheduled payments, it may default, leading to credit losses for lenders and counterparties.Examples include businesses that disappeared during the COVID-19 pandemic in 2020.

- Uninsured Events Impacting Repayment :

- Credit losses can result from unexpected and uninsured events that rapidly destroy an entity.Examples include businesses affected by unforeseen events like wildfires in California.

- Unwillingness to Pay :

- Although less common, credit risk can arise from an obligor’s unwillingness to pay, often stemming from commercial disputes over contract validity.

- Timing-Related Credit Losses :

- Credit losses may arise from timing issues, such as delayed repayments leading to foregone interest income or working capital finance charges.

- Coupling with Political Risk :

- Sometimes, obligors may have the ability and willingness to repay, but government actions, like currency conversion, impact the value of accounts.The “pesification” in Argentina in 2002 is cited as an example

- Time as a Factor :

- Longer-term contracts increase the risk due to the extended period, raising the possibilities of inability, unwillingness, or non-timeliness of repayment.

Insolvency, Default And Bankruptcy

- Insolvency

- Definition: State where obligor’s liabilities surpass their assets, causing them unable to meet obligations.

- Nature: Financial condition with potential legal and economic consequences.

- Distinguishing Factor: Not a legal procedure; it signifies a financial state.

- Default:

- Definition: Failure to fulfill a financial contract, such as a late payment, covenant breach, or violation of agreement terms.

- Causes: Can result from both insolvency and illiquidity.

- Significance: Marks the point at which an obligor fails to meet financial obligations.

- Bankruptcy

- Initiation: Legal proceedings often initiated after a default.

- Legal Framework: Involves court intervention under chapter laws (e.g., Chapter 11 or Chapter 7 in the United States).

- Purpose: Review the defaulted entity’s financial situation, negotiate among stakeholders (management, creditors, equity owners).

- Outcome: Aims to preserve the entity’s business through asset sales, renegotiations, or, if necessary, dissolution.

- Loss Management: Bankruptcy procedures designed to manage losses and distribute them orderly among stakeholders.

- Focus: Legal intervention and structured processes to address financial distress.

Transactions Generating Credit Risk

- Identifying situations leading to financial loss from counterparty default is crucial in credit risk management. Traditionally, credit risk focused on cash or product exchanges in bank lending and trade receivables. Modern banking products have introduced sophisticated transactions generating substantial credit exposures without direct lending or product sales. Seven common business arrangements that generate credit risk are as follows –

- Lending:

- Involves cash outflow from lender to borrower with a promise of later repayment.

- Traditional form actively managed in credit risk.

- Leases:

- Entity (lessor) makes equipment/building available to another entity (lessee).

- Lessee commits to regular payments, and lessor often finances assets through borrowing.

- Sale of Products or Services with Deferred Payment:

- Seller sends an invoice after shipping product or performing service.

- Buyer has a few weeks to pay, creating an account receivable.

- Prepayment of Goods and Services:

- Involves advanced payment for expected delivery of goods or services.

- Failure of the counterparty leads to loss of advanced payments and potential business interruption costs.

- Claims on Assets in Custody (Bank Deposits):

- Individuals choose banks based on services, but large corporates assess creditworthiness.

- Concerns about potential default of banks holding deposits, leading to risk management strategies.

- Contingent Claims:

- Claims contingent on specific events, e.g., loss covered by an insurance policy.

- Pension funds with claims on sponsor assets if liabilities exceed assets, posing credit risk to participants.

- Derivative Exposures:

- Arises from derivatives transactions like interest rate swaps or foreign-exchange futures.

- Future payments dependent on the market value of an underlying product, resulting in credit risk.

Credit Type Losses Result From Loss Type Loaned money Nonrepayment Slow repayment Dispute/enforcement Face amount, interest Time value of money Frictional costs Lease obligation Nonpayment Recovery of asset, remarketing costs, difference in conditions Receivables Nonpayment of goods delivered or service performed Face amount Prepayment for goods or services Nondelivery Performance on delivery not as contracted Slow delivery Dispute/enforcement Replacement cost Incremental operating cost Time value of money Frictional costs Deposits Nonrepayment Face amount Time value of money Claim or contingent claim on asset Nonrepayment/Noncollection Slow repayment/Slow collection Dispute/enforcement Face amount Time value of money Frictional costs Derivative Default of third party Replacement cost (mark-to-market value)

- Lending:

Key Points:

- Primary Source of Credit Exposure:

- Corporate obligations constitute the predominant source of credit exposure in the United States.

- Total Debt in U.S. Debt Markets:

- Approximately $55.5 trillion of debt outstanding in U.S. debt markets, including noncredit risky instruments like U.S. Treasury obligations and government-sponsored enterprise (GSE) obligations.

- Credit Risk in Instruments:

- Majority of credit risk lies in instruments issued by the corporate sector, including corporate bonds, bank loans, and commercial paper.

- Financial Corporations vs. Nonfinancial Corporations and Households:

- Financial corporations contribute significantly more to credit exposure than nonfinancial corporations and households.

- Exclusion of Certain Debt:

- Federal government debt and household-mortgage debt (mostly agency-backed) are excluded, as they are considered to have no associated credit risk exposure.

- Global Notional Credit Exposure from Derivatives:

- Estimated potential notional credit exposure from derivative transactions exceeds $600 trillion globally as of June 2020.

- Composition of Derivative Exposure:

- The majority of this exposure comes from over-the-counter (OTC) interest-rate derivative contracts, with around $30 billion traded on exchanges.

Who Is Exposed To Credit Risk ?

- In the intricate world of finance, credit risk is a pervasive force affecting both institutions and individuals, whether by design or circumstance. This exposure is not universally negative; entities like banks and hedge funds excel at navigating and profiting from their ability to manage credit risk. Similarly, individuals strategically opt for investments in fixed income bond funds to secure additional returns compared to U.S. Treasury bonds. Meanwhile, industrial corporations and service companies, conducting transactions without upfront payments, inevitably face credit risk as an integral aspect of their core activities.

Exposure to credit market instruments by entity, USD Billions

- In this figure, the distribution of exposure to debt securities from corporations and other entities is highlighted, unveiling a diverse landscape of risk-bearing entities. Leading the list are financial institutions, including public and private pension funds, mutual funds, banks, and insurance companies, holding the most significant exposure. Close behind are households and nonprofits, foreign entities, and government sectors at different levels.

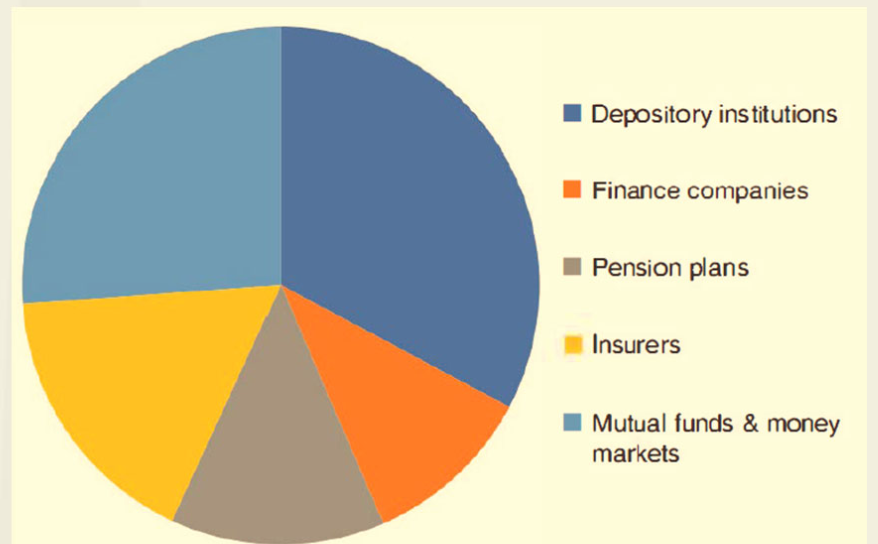

Who Is Exposed To Credit Risk ? Financial Institutions

- Financial institutions have substantial credit risk exposure. In this figure, the financial sector’s breakdown reveals entities holding exposure to debt instruments. Depository institutions and mutual funds take the lead, each carrying substantial exposure. This intricate interplay of credit risk emphasizes its strategic significance, particularly for financial institutions facing notably high stakes. As we delve further, we will explore the intricate circumstances influencing credit risk exposure across diverse entities and sectors.

Financial institutions’ exposure to credit market instruments, USD Billions

Banks

- Banks, being in the business of extending credit, possess the largest credit portfolios and sophisticated risk management structures. Their exposure to credit risk is multifaceted, encompassing direct lending, issuing letters of credit, and engaging in off-balance-sheet activities like loan commitments and financial guarantees. Direct financial losses for banks occur if borrowers default, making rigorous credit assessment procedures imperative during credit approval. Continuous monitoring of borrower creditworthiness is also standard practice.

- Regulatory requirements, such as the Basel Accords, mandate that banks maintain specific levels of capital reserves as a buffer against loan defaults. This regulatory framework ensures banks remain resilient in the face of credit risk challenges.

- The evolving banking landscape has seen a shift in banks’ focus from traditional lending toward fee-generating services like mergers-and-acquisitions advisory services and debt and equity issuance. Despite this shift, loans and lines of credit continue to constitute the largest sources of credit risk for banks. Loans, including asset-based lending like repurchase agreements (“repos”) and securities lending, involve lending money or securities against collateral. The collateral, typically Treasury bonds or equity, serves as a safeguard; if the borrower defaults, the lender can sell the collateral, reducing or eliminating losses. Despite these risk-mitigation strategies, banks meticulously manage exposures, especially during volatile financial market conditions.

- To mitigate the potential for significant losses, banks maintain specialized risk management teams dedicated to analyzing credit risk by utilizing measures like credit scoring models and risk ratings and reviewing legal documents associated with loans. Furthermore, banks increasingly turn to capital markets to hedge credit risk exposure associated with loans.

- Beyond loans, the derivatives business emerges as a significant generator of credit risk exposure for banks. Derivatives introduce a form of credit risk known as “derivative counterparty” exposure. Notably, JPMorgan Chase & Co. faced substantial derivative receivables counterparty credit risk exposure at the end of 2020, primarily from interest-rate contracts, foreign exchange contracts, credit derivatives, equity contracts, and commodity contracts. This exposure, while seemingly large in ratio, represents potential losses in the event of default by all counterparties on the exposure valuation date, adjusted for cash and liquid security collateral.

Asset Managers

- Asset managers are exposed to credit risk as they operate by collecting funds from individuals and institutions to invest on behalf of their clients. The nature of their business involves making investment decisions that align with their clients’ risk and return objectives. The exposure to credit risk arises in the following circumstances:

- Investment Selection: Asset managers face credit risk when selecting investments for their portfolios. They carefully assess the creditworthiness of corporate or sovereign borrowers before making investment decisions. This scrutiny is crucial as it directly impacts the performance of the fund and the potential for losses to clients.

- Diverse Investment Options: The range of investment options, such as money-market funds or equities, introduces varying degrees of credit risk. For example, cautious investors opting for money-market funds are exposed to short-term and high-quality debt, while those with a higher risk appetite may invest in equities or emerging markets debt and equity.

- Magnitude of Managed Assets: Large asset management firms, like Blackrock or Vanguard Group, handle substantial amounts of third-party money, often exceeding trillions of dollars. The sheer scale of managed assets increases the exposure to credit risk, emphasizing the need for diligent credit analysis and risk management practices.

- Balancing Risk and Return: While portfolio managers may be enticed by investments promising high returns, risk managers within asset management firms play a crucial role in discouraging such decisions. They recognize the potential credit risk associated with high- return investments and aim to protect clients from the possibility of non-repayment.

Hedge Funds

- Hedge funds, characterized by their substantial daily investments and high-risk appetite, carry significant credit exposure. Their unique approach, marked by aggression and a focus on riskier financial instruments, sets them apart from traditional asset managers. Unlike standard investors, hedge funds engage in transactions that transfer risk, enabling various business dealings that might not otherwise happen. Some key points are –

- Riskier Financial Instruments: Hedge funds, driven by their investors’ higher risk tolerance, invest in riskier financial instruments not commonly accessible to traditional asset managers. This increased risk appetite amplifies their exposure to credit risk.

- Facilitating Risk Transfer: Hedge funds play a pivotal role in facilitating transactions that involve risk transfer. Examples include purchasing distressed loans, selling protection against credit declines, and taking on the riskiest positions in commercial real estate financing. These activities enable the necessary transfer of risk to facilitate transactions.

- Proactive Role in Corporate Restructurings: In corporate restructurings, hedge funds take a proactive role to maximize their recoveries, leveraging their investments in risky debt to influence outcomes.

- Viewing Defaults as Opportunities: Unlike traditional financial institutions focused on avoiding defaults, some hedge funds view the possibility of an entity defaulting as an opportunity to deploy capital. They engage in transactions like short-selling or writing options to profit from financial distress, even without direct exposure to the obligor.

- Credit Default Swaps (CDS) and Short-Selling: Hedge funds employ strategies involving credit default swaps (CDS) and short-selling to profit from deteriorating financial situations. The growth in derivatives products, such as CDS, facilitates these strategies.

- Risks in Short-Selling: Short-selling transactions, while potentially profitable, involve considerable risk. Factors like successful turnarounds by new management or unexpected market conditions can impact the success of these strategies. The case of Melvin Capital in January 2021 exemplifies the risks associated with short-selling. Their short-selling transactions on GameStop, anticipating a decline in share prices, resulted in significant losses when individual investors drove up the share prices unexpectedly. This case underscores the complexities and risks inherent in hedge fund strategies.

Insurances Companies

- Insurance companies face credit risk in various aspects of their operations, primarily in underwriting activities, the investment portfolio, and reinsurance recoverables. Here is a breakdown of the entities exposed to credit risk and the circumstances under which exposure occurs for insurance companies:

- Underwriting Activities:

- Trade Credit Insurance and Surety Bonds: Insurers offering trade credit insurance on receivables and surety bonds expose themselves to credit risk. Losses may occur if a company covered by these instruments defaults.

- Example: The bankruptcy of Thomas Cook in 2019 resulted in significant losses for insurers providing coverage, highlighting the credit risk associated with underwriting activities.

- Investment Portfolio:

- Cash Investment: Insurance companies, similar to asset managers, collect premiums and invest the funds. As a result, insurance companies stand out as some of the largest and most involved institutional investors. The sizeable cash reserves for investments increase exposure to credit risk.

- Strategic Asset Allocation: The strategic asset allocation process involves managing a trade-off between expected returns (favoring shareholders) and maintaining a low-risk profile (favoring policyholders). Here, a critical factor is credit risk, requiring careful management. Dedicated teams manage credit positions, even when day-to-day management is outsourced to third-party asset managers.

- Separate Account Management:

- FiduciaryDuty: Life insurance companies handle funds on behalf of their policyholders through separate accounts. Although these assets are not owned by shareholders, credit losses may impact the insurer’s reputation and future business opportunities.

- Guaranteed Investment Returns:

- Product Guarantees: Insurers offering products with guaranteed minimum investment returns face credit risk. Severe credit losses may compel insurers to fulfill guarantees by depleting their capital, potentially leading to insolvency.

- Reinsurance Activities:

- Risk Transfer to Reinsurers: Primary insurers transfer risks to reinsurers via reinsurance contracts, protecting against large claims. Credit risk arises if reinsurers face financial distress or disappear between claim reporting and payment.

- Credit Risk in Catastrophic Events: For catastrophic losses like earthquakes or hurricanes, the credit risk increases. Reinsurers may lack resources to fulfill payments, emphasizing the importance of selecting diverse and reliable reinsurance partners, a challenging task due to the industry’s high concentration.

- Reinsurance Recoverables: Reinsurance introduces another credit risk in the form of a contingent claim the insurer has on the reinsurer. Unlike receivables, where the primary insurer knows its losses and submits a claim, liability policies may involve a significant time gap between premium collection and claim settlement. The insurer estimates potential claims, creating a contingent claim on the reinsurer, which is termed as a “reinsurance recoverable”. This asset, larger than receivables, represents a substantial item on the insurer’s balance sheet, often the largest after invested assets.

- Evolution of Reinsurance Market:

- Alternative Capital: The emergence of alternative capital in the reinsurance market introduces new dynamics. Investors, providing capital to reinsurers, eliminate credit risk through full collateralization, requiring cash in advance equal to their maximum liability.

- Underwriting Activities:

Pension Funds

- Like life insurers managing funds for policyholders, pension fund sponsors (e.g., corporate employers) handle investments for plan members. As of September 2020, the private sector and corporations held $3.5 trillion in defined benefit pension assets, while state and local government plans had $9 trillion, and U.S. federal government plans had $3.8 trillion. A significant portion of these funds is invested in credit-risky assets. Both private and public pension funds, governed by ERISA (Employee Retirement Income Security Act of 1974) and similar standards, must actively manage credit risk, even if third-party managers handle asset management.

Who Is Exposed To Credit Risk ? Corporates

- Corporates are exposed to credit risk through various facets of their operations. The primary sources of credit risk for corporates include:

- Account Receivables:

- Corporates extend short-term credit to customers, and the default risk arises when customers fail to make payments on time.

- The credit risk is particularly significant in the retail industry, where bankruptcy of customers can lead to negative publicity, impacting stock prices and operational reputation.

- Investment of Excess Cash:

- Large corporates, having substantial amounts of cash, invest in short-term securities and deposit in banks.

- Despite preferring safe investments, the credit risk persists, as demonstrated during the 2007 crisis, emphasizing the need for evaluating the creditworthiness of banks.

- Derivative Trading Activities:

- Corporates engaged in derivative trading, such as commodity futures, face credit risk due to counterparty exposure.

- In long-term, fixed-price contracts, both parties are exposed to credit risk, especially when dealing in commodities with volatile prices.

- Clearinghouses and margins help mitigate credit risk in organized exchanges, but forward contracts expose corporates to large credit risk.

- Vendor Financing:

- Some corporates, particularly in technology, heavy equipment, and automobile industries, provide vendor financing to help clients acquire or lease products.

- The risk lies in potential customer defaults on repayments, leading to credit losses.

- Supply Chain Risk:

- Corporates are exposed to credit risk from their supply chain, as bankruptcy or default of major suppliers can disrupt operations and lead to financial losses.

- Diversifying partners and monitoring the credit quality of companies in their ecosystem becomes crucial to mitigate this risk.

- Industry-Specific Activities:

- Corporates involved in industries like agriculture, food, energy, and utilities engage in activities, such as commodity trading and forward contracts, that expose them to significant credit risk.

- Credit management teams play a vital role in assessing and mitigating risks associated with these activities.

- Unique Suppliers:

- Depending on unique or major suppliers can be a credit risk. Bankruptcy or default of such suppliers can have severe consequences, disrupting the supply chain and causing financial losses.

- Customer Defaults in Vendor Ecosystem:

- Corporates providing capital or support to suppliers within their ecosystem may face credit risk if these suppliers default, impacting the corporates’ operations and financial health.

Who Is Exposed To Credit Risk ? Individuals

- Credit risk is often overlooked by many individuals, but every household is inherently exposed to it. Some of the ways in which individuals are exposed to credit risk can be:

- Contractor/Service provider/Vendor Advances:

- Individuals face credit risk when making advance payments to for services or goods to service providers, contractors, or vendors. If they fail to complete their obligation, the individual may incur financial losses, highlighting the associated credit risk.

- Investment Decisions:

- Individuals, like insurers and corporates, handle credit risk in their investments. For instance, when choosing mutual funds, investors decide between high-yield and investment-grade bond funds. Opting for high-yield funds means taking on more credit risk for potentially higher returns.

- Bank Deposits:

- Money deposited in banks exposes individuals to credit risk, especially when regulators shut down banks. The closure of banks can result in financial losses for clients. However, in many countries, protective measures are in place to mitigate such risks. In the United States, the Federal Deposit Insurance Company (FDIC) guarantees deposits up to $250,000 per account, providing a safety net for individuals against credit risk associated with bank failures.

Motivations For Managing Credit Risk

- Motivating factors for managing or taking on credit risk are integral to many aspects of a company’s operations and financial health:

- Survival: Effective credit risk management is crucial for both financial institutions and corporations, as large credit losses can lead to bankruptcy, emphasizing the need for survival. A focus on long-term survival necessitates a robust credit risk management strategy. Well- managed credit portfolios are resilient to both expected small losses and unforeseen, potentially devastating large losses, contributing to stability and longevity.

- Profitability: Linking directly to credit risk management, profitability thrives when the impact of credit losses is minimized. This is vital in industries with low profit margins, making prudent credit risk management instrumental for sustained financial performance.

- Return on Equity: Striking the right balance between equity and risk is essential for maintaining a satisfactory return on equity. Active credit risk management optimizes this balance, ensuring a sufficiently high amount of equity complemented by effective risk mitigation.

- Competitive Advantage: Companies with effective credit risk management principles often outperform peers during economic downturns. Proactive credit portfolio management provides a competitive advantage, enabling companies to navigate challenging economic environments and maintain stability.

- Liquidity: Offering credit can attract more customers and enhance liquidity. Loans and credit lines generate interest income, which can contribute to the financial health and stability of a lending institution.

- Risk Diversification: Diversifying credit portfolios helps financial institutions spread risk. This reduces the impact of defaults on any single loan or sector.

- Business Growth: Supporting the growth of businesses through credit helps foster economic development. Lenders may provide financing to businesses to enable them to expand operations, hire more employees, and contribute to overall economic growth.