Credit Scoring & Rating

Instructor Micky Midha

Updated On Learning Objectives

- Compare the credit scoring system to the credit rating system in assessing credit quality and describe the different types of each system.

- Distinguish between through-the-cycle and point-in-time credit rating systems.

- Describe the process for developing credit risk scoring and rating models.

- Describe rating agencies’ assignment methodologies for issue and issuer ratings, and identify the main criticisms of the credit rating agencies’ ratings.

- Video Lecture

- |

- PDFs

- |

- List of chapters

Chapter Contents

- Introduction

- Credit Scoring And Rating Systems

- Types Of Rating Philosophies

- Issuer Ratings And Issue-Specific Ratings

- Behavioral And Profit Scoring

- Social Lending

- Modelling Requirements

- Development Process

- Data Collection And Pre-Processing

- Model Fitting

- Model Validation

- Definition And Validating Of Ratings

- Implementation, Monitoring And Review

- Criticisms Of Ratings

Introduction

- Credit scoring and rating are essential for managing credit risk, serving beyond loan approval by aiding in loan pricing and portfolio management. These systems streamline risk monitoring for individual loans or portfolios and simplify reporting processes, internally and externally. They also provide analytical tools for setting capital requirements and managing customer relationships.

- The benefits of these systems include:

- Minimizing subjectivity in loan evaluations.

- Enabling analytical risk management, including scenario analysis and stress testing.

- Promoting consistency and transparency in customer evaluation.

- Decreasing the time and cost required for loan appraisal.

Credit Scoring And Rating Systems

CREDIT SCORING SYSTEM

- Nature:

- Numerical Score: Credit scoring generates a numerical score for each borrower.

- Objective Measure: It provides an objective measure of creditworthiness and probability of default.

- Usage:

- Internal Use: Credit scores are primarily used internally by financial institutions and corporate clients.

- Types:

- Automated Models: Credit scoring relies on automated analytical models.

- Objective Criteria: These models assess credit risk based on objective criteria such as payment history, debt-to-income ratio, and credit utilization.

- Continuous Monitoring: It enables continuous monitoring of borrowers’ credit profiles.

CREDIT RATING SYSTEM

- Nature:

- Ordinal Qualitative Scale: Credit rating assigns a risk rating expressed on an ordinal qualitative scale.

- Empirical Estimation: Each risk grade is associated with an empirically estimated Probability of Default (PD).

- Usage:

- External Use: Credit ratings are typically used externally for corporate loans, bond issues, and sovereign credit ratings. They are often publicly available.

- Types:

- Analytical and Judgmental: Credit rating may involve a combination of analytical and judgmental assessments.

- Manual Process: It relies on a more elaborate and in-depth process compared to credit scoring.

- Risk Exposure Assessment: It evaluates the risk exposure for a portfolio of loans or investments.

Types Of Rating Philosophies

- The regulatory framework established by the Basel Committee on Banking Supervision recognizes two distinct credit rating philosophies: through-the-cycle and point-in-time.

- Through-the-Cycle Credit Rating System:

- Focus: Primarily utilized by major credit rating agencies.

- Timeframe: Offers a long-term orientation covering at least one business cycle.

- Robustness and Stability: Designed to be robust against short-term fluctuations.

- Updates: Less frequently updated compared to point-in-time assessments.

- Use Cases: Suited for long-term risk assessments and portfolio management.

- Point-in-Time Credit Rating System:

- Usage: Typically employed by internal systems of credit institutions and banks.

- Focus: Analyzes the current and short-term condition of borrowers within a predefined period, often not exceeding one year.

- Volatility: Ratings are more volatile due to their immediate reflection of borrower status changes.

- Updates and Responsiveness: Updated promptly to incorporate new borrower information.

- Use Cases: Primarily used for short-term transactions and loans requiring timely assessments.

Issuer Ratings And Issue-Specific Ratings

- Issuer Credit Ratings:

- Provide forward-looking opinions on an entity’s creditworthiness.

- Can be long-term or short-term, depending on the analysis scope.

- Include various types such as counterparty, corporate, and sovereign credit ratings.

- Sought by entities to enhance access to capital markets and funding.

- High ratings signify strong debt repayment history and low default risk, improving financing opportunities and stakeholder relationships.

- Issue-Specific Ratings:

- Assess creditworthiness for a specific financial obligation, like a loan.

- Consider factors such as loan terms, collateral, and intended use of funds.

- Focus on the risk profile of a particular debt issue rather than the entity’s overall creditworthiness.

Behavioral And Profit Scoring

- Behavioral scoring, employed in consumer lending, assesses the risk of existing customers based on their observed behavior. Unlike static credit scores, which rely on application data for new customers, behavioral scores are updated monthly using various data points such as account balances and payment history. These scores dynamically monitor customer behavior, providing updated default risk estimates. They are utilized for setting credit limits, managing debt collection, and for marketing purposes, such as offering new financial products.

- In contrast, profit scoring focuses on the likelihood of credit granting being profitable. It integrates marketing, pricing, and operational decisions with credit risk assessment. There are two types: account-level and customer-level models. Account-level scoring calculates profits from specific accounts, while customer-level scoring considers all accounts of a customer, offering a comprehensive outlook for promoting new financial products.

Social Lending

- With the rise of Fin Tech, peer-to-peer (P2P) lending has gained popularity as an alternative financing channel for both corporations and individuals. P2P lending, facilitated through online platforms, allows direct transactions between borrowers and lenders, bypassing traditional financial institutions. Originating in the mid-2000s, platforms like Zopa and Prosper have experienced rapid growth, with the UK and US markets showing significant expansion.

- However, the P2P lending market remains largely unregulated, posing higher default risks compared to traditional lending due to the absence of collateral and guarantees. Credit risk modeling tailored to P2P lending is essential, addressing the unique challenges and requirements of investors, lenders, and borrowers. This includes adapting credit scoring and rating models to account for the lack of traditional safeguards and the abundance of online data. Transparency and effective management of big data are crucial in ensuring trust and accountability within the online lending ecosystem.

Modelling Requirements

- The development and use of credit scoring and rating models are governed by regulatory requirements set by central banks and international supervisors. According to Basel Committee rules, credit scoring and rating systems must adhere to key specifications:

- Meaningful Risk Differentiation:

- Prioritize distinguishing risk over minimizing regulatory capital requirements.

- Clearly define grades to represent varying levels of credit risk.

- Ensure differential treatment of borrowers within the same grade based on transaction characteristics to avoid excessive concentration of risk.

- Continuous Borrower Evaluation:

- Re-rate all borrowers and loans annually to consider new borrower information.

- System Oversight:

- Continuously monitor system operation for accuracy.

- Implement adequate controls, such as stress tests, and establish a feedback mechanism to maintain integrity.

- Proper Risk Assessment Attributes:

- Demonstrate the ability to analyze borrower creditworthiness using appropriate risk factors and attributes.

- Substantial Data Collection:

- Utilize a representative database incorporating historical borrower data, credit scores, ratings, probability of default estimates, credit migration data, and payment history.

Development Process

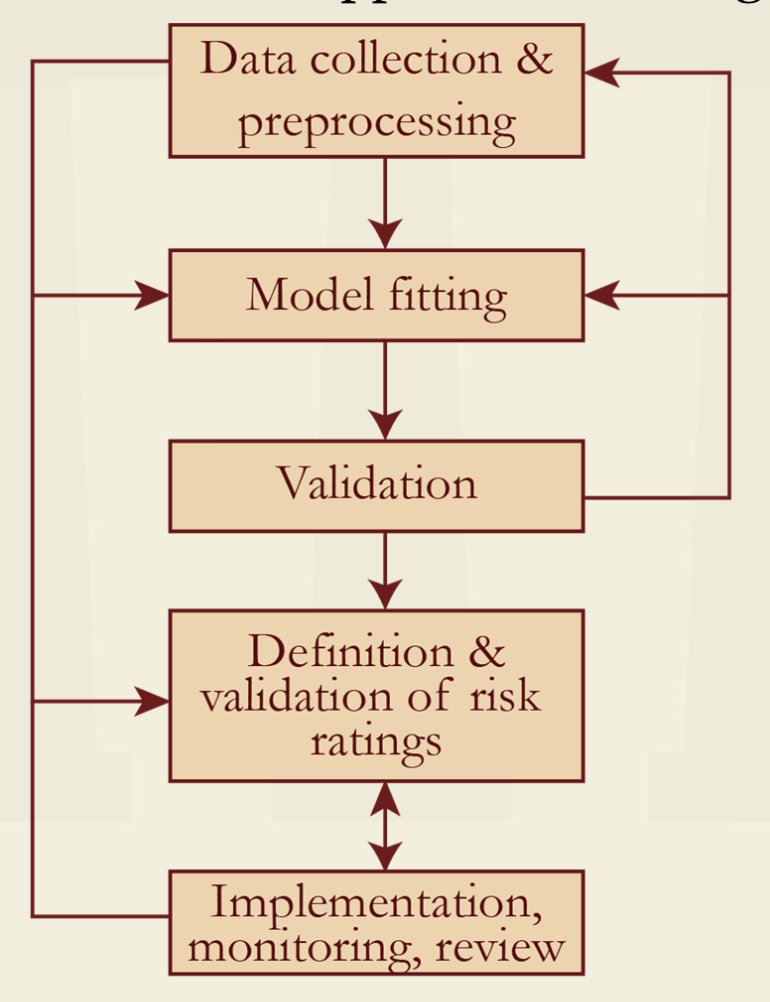

- Building credit scoring and rating models is a complex, data-intensive process that requires technical know-how as well as analytical skill. Advanced technological capabilities and analysts’ subjective judgment are combined in this approach. This figure shows a summary of this procedure.

Data Collection And Pre-Processing

- Once the objectives and context of the credit model are established, the process commences with data collection for model construction. Data collection typically involves gathering information on defaulted and non-defaulted cases. Default is often defined as overdue payments exceeding 90 days, but this definition is tailored to each institution’s context and model usage. Data can be sourced internally from historical databases or externally. During this phase, preprocessing is essential to transform data into meaningful risk attributes, removing outliers, and selecting relevant attributes. Algorithmic procedures and statistical tests help assess attribute information value and discriminatory power, while expert judgment aids in selecting meaningful attributes.

- Credit scoring and rating models utilize a mix of quantitative and qualitative attributes to assess borrower creditworthiness. It is crucial to minimize subjectivity when incorporating qualitative data and ensure consistency throughout the data collection and processing stages.

- For consumer loans, risk assessment considers factors such as borrower income, assets, existing loan payments, payment history, family and social status, employment status, collaterals, guarantees, and loan type and purpose.

- Corporate credit risk models consider financial/accounting information, behavioral and transaction data, company size and age, market conditions, competitive advantages, stock market data (for listed companies), corporate governance, corporate news and analytics, and external factors like business sector data and regional/country-level information.

- Financial Data – Financial information comes from publicly available corporate financial statements – balance sheets, income statements, and cash flow statements. Financial ratios, created by combining this data, provide insights into a firm’s profitability, solvency, liquidity, and management efficiency.

- Profitability ratios assess a firm’s efficiency in using assets and capital to generate profits, including return on assets, equity, and various profit margins.

- Solvency ratios evaluate a firm’s debt levels with metrics like debt to assets and interest coverage, indicating reliance on external financing.

- Liquidity ratios measure a company’s ability to meet short-term obligations, using metrics such as working capital and current ratios.

- Management efficiency ratios examine how effectively a firm converts assets into cash and manages supplier credit, through turnover of inventories, receivables, and payables.

- Financial ratios are often analyzed using the latest data when reviewing a loan application, but growth indicators, which offer a dynamic perspective on a firm’s status through sales and operations growth over 3-5 years, are also important.

- Behavioral and Transaction Data – Transaction data, covering daily operations and dealings with creditors, focus on payment history and behaviors like credit limits and delinquencies. This provides a regularly updated, dynamic view of a borrower’s creditworthiness compared to the less frequent updates of financial statement data.

- Size and Age – Studies show corporate defaults are linked to a company’s size and age. Larger companies often have access to cheaper financing and better credit terms due to their scale, whereas smaller and newer companies face greater vulnerability and limited financing options, complicating credit risk assessments. Common measures of company size include total assets, revenues, and, for listed companies, market capitalization.

- Market Conditions and Competitive Advantages – Understanding market conditions is crucial for assessing a company’s prospects, including competition levels, market openness, regulations, and trends. A firm’s competitive advantages, such as technological, R&D, innovation, supply chain benefits, and diversification, are very important. Additionally, the firm’s network, including the status of major suppliers and customers, impacts its performance and risk exposure, especially if reliant on entities with low creditworthiness.

- Financial Markets Data – Publicly traded firms provide real-time market data such as stock prices, return volatility, and various valuations (e.g., price-to-earnings, price-to-book, earnings per share). Critics argue that accounting-based data, unlike stock market data, are static and backward-looking, reflecting past performance rather than future prospects. Stock prices reflect all available information about a firm’s current status and future potential. Market data, including stock return volatility and valuation ratios, are crucial for assessing credit risk. The Black-Scholes-Merton model relies on market data for default risk estimation.

- Corporate Governance – Recent practices and research in corporate credit scoring have expanded to include non-financial data alongside financial and market data. An emerging trend involves considering corporate governance information, such as management practices and business ethics. Corporate scandals like those involving Enron, WorldCom, and Lehman Brothers have increased academic interest in governance practices. Corporate governance addresses issues such as board composition, executive competence, transparency, and shareholder rights. Studies have shown a positive relationship between corporate governance and performance. Integrating these factors into credit rating models provides valuable insights into the long-term stability and financial health of corporate clients.

- Corporate News and Analytics – Leveraging a wide range of news sources, including press releases, mainstream media, social media, and alternative media helps to evaluate creditworthiness of borrowers. Additionally, there is a recent trend on utilizing corporate news from various online sources, such as social networks, to enhance credit scoring for both corporate and consumer loans. This wealth of information enriches traditional analytical models with insights into companies’ operations, market status, strategic planning (e.g., mergers and acquisitions), and business relationships. However, managing the vast volume of data presents challenges, driving the adoption of advanced technologies like text and social network analytics, leading to the development of big data systems.

Model Fitting

- The second stage involves the model being fitted, where parameters are identified to best describe the training data. This process aims to have the optimal estimates for the model’s elements based on the provided training data.

- It is essentially an optimization problem where the differences between the model’s output and the given classification of the training cases are minimized using a loss function. This empirical problem serves as a basis for model construction since the true objective of minimizing loss from applying the credit model to any borrower is not feasible due to unavailable and changing borrower populations over time.

- The optimization problem can be expressed in various analytical forms such as unconstrained optimization, linear and nonlinear programming, depending on the prediction model’s structure and the choice of the loss function.

- On the algorithmic side, different methodologies like statistical, data mining, and operations research techniques are employed for model fitting, each with its advantages and limitations.

Model Validation

- The model derived from the training process must be validated against a separate sample, known as the validation or holdout sample. This sample uses the same risk attributes as the training set but involves different cases (borrowers/loans). The aim of validation is to assess the model’s expected predictive performance in a real-world context. Various performance measures, including statistical and economic measures, are used, and if the results are unsatisfactory, the model fitting process may need repetition or re-initiation from the data processing phase.

- A crucial aspect of validation involves analyzing the model’s performance in terms of quality and robustness. Backtesting, which evaluates the model’s predictive ability using historical data not used for constructing the model, is commonly employed. Out-of-sample tests apply the model to borrowers not included in the sample used for building the model, while out-of-time tests assess the model’s robustness over different time periods. Ideally, combining out-of-sample and out-of-time tests provides more reliable estimates of the model’s true performance.

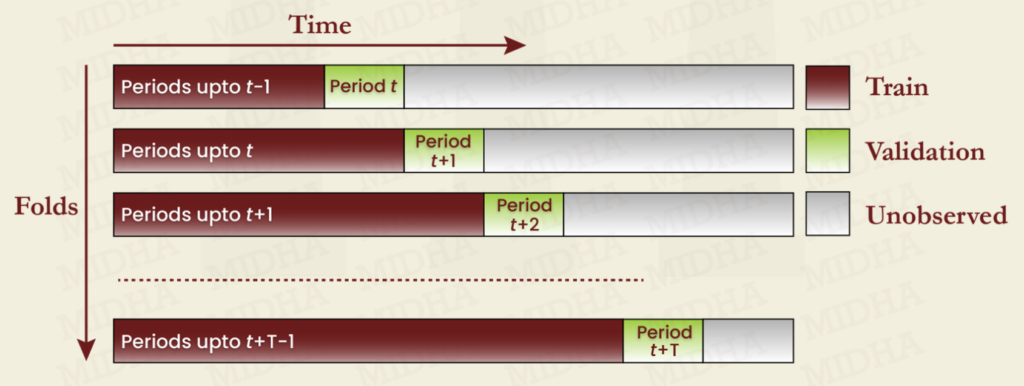

- However, a single test may not offer conclusive results about a credit scoring/rating model’s predictive ability across different instances. Walk-forward testing addresses this by testing the model over consecutive runs, moving one time period ahead each time. During testing period 𝑡, data from the preceding periods, upto 𝑡 – 1, are considered. The observation window then shifts forward by one time period, resulting in the inclusion of period 𝑡, in the subsequent testing period, 𝑡 + 1. This chosen credit risk modeling approach undergoes testing across 𝑇 + 1 consecutive runs, as shown in the figure. This allows for a comprehensive assessment of the model’s performance across different time frames. To further improve the reliability of walk-forward testing, additional enhancements can be implemented through resampling techniques such as bootstrapping and cross-validation.

- Benchmarking offers an alternative to backtesting for model validation. It involves comparing a credit model’s results with external assessments, such as ratings issued by credit rating agencies. While back-testing relies on statistical methods to compare model estimates against realized outcomes, benchmarking focuses on qualitative comparisons against external sources. The objective of benchmarking is not to precisely replicate external benchmarks but to identify significant discrepancies and analyze underlying reasons. These discrepancies may stem from differences in goals and customer bases between internal models and external benchmarks, suggesting the need for model calibration and improvement. Proper selection of benchmarks is crucial to ensure meaningful results.

Definition And Validating Of Ratings

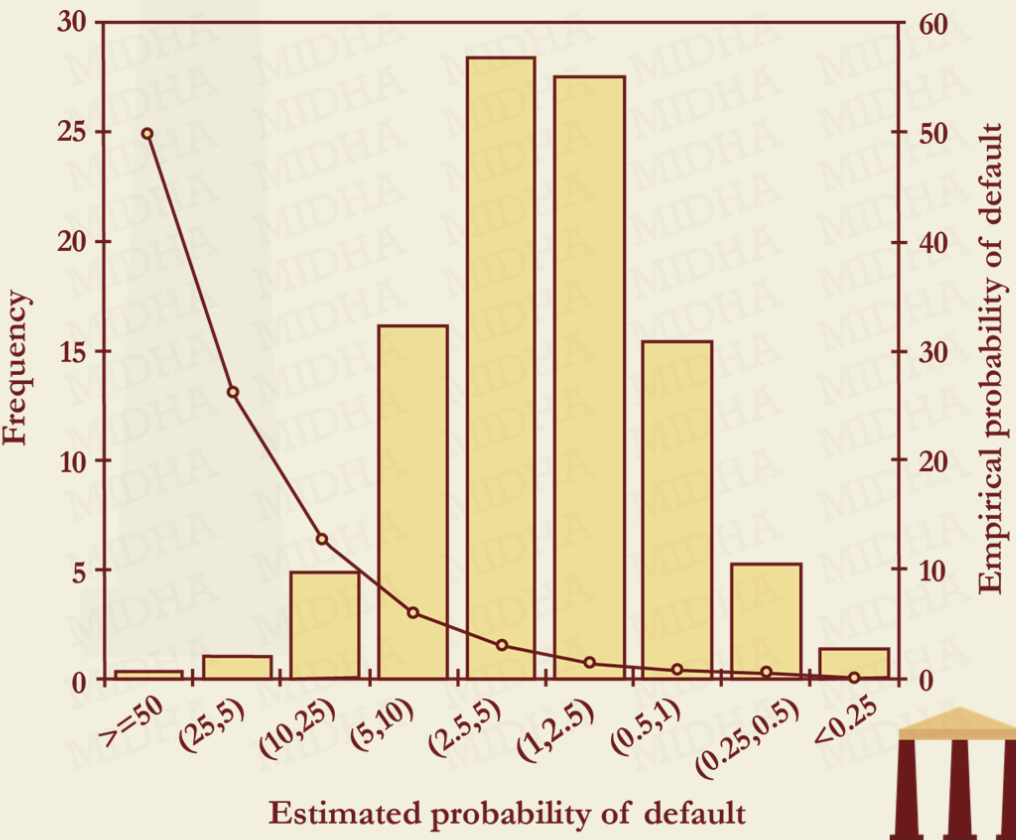

- Once the credit rating model passes validation, credit scores are typically translated into risk rating classes. These classes usually comprise at least ten categories, offering a detailed classification of borrower risk levels. Constructing these rating grades involves several considerations. For instance, each rating class should be linked to empirical Probability of Default (PD) estimates, ensuring diversity between adjacent categories. Additionally, the distribution of borrowers across risk categories should avoid excessive concentration in specific grades.

- The figure illustrates an example where a credit scoring model defines nine risk grades based on their Probability of Default (PD), from low risk (PD < 0.25%) to high risk (PD ≥ 50%). The distribution of borrowers across these grades shows no excessive concentration, as the maximum concentration is in the middle categories, which hold less than 30% of cases. As the risk grade increases, the empirical PD, which is calculated as the ratio of defaulted borrowers to the total in each grade – roughly doubles, indicating effective risk differentiation. The empirical PDs closely align with the model’s estimated PD ranges, affirming the model’s accuracy in rating calibration.

Similar to model validation, the rating scheme should undergo validation for stability over time, borrower distribution, and consistency between estimated and empirical PDs. If validation results are unsatisfactory, adjusting the rating specifications should be considered first, with constructing a new model as a last resort.

Implementation, Monitoring And Review

- The final step in this process integrates the results into a credit scoring or rating system, which then provides real-time credit risk assessments for all new loan applications. This system is subject to regular monitoring and evaluation to ensure its effectiveness. Updates are made either through recalibration of the ratings, without changing the underlying decision model, or by developing a new model altogether if there is a significant and persistent decline in the precision and reliability of the risk estimates produced.

Criticisms Of Ratings

- Despite being widely utilized by various entities including investors, financial institutions, regulators, and corporations, credit ratings issued by Credit Rating Agencies (CRAs) have faced substantial criticism on several fronts:

- Lack of transparency and accountability: Their rating processes are typically undisclosed, raising concerns about their practices. Additionally, their revenue dependence on fees of rated entities raises questions regarding potential conflicts of interest.

- Promotion of debt expansion: While credit risk scoring and rating have improved risk management practices, resulting in lower risk premiums and debt financing costs, this accessibility to debt may contribute to systemic risk, potentially leading to credit bubbles and crises.

- Limited predictive ability: The inability of CRAs to forecast significant corporate failures during crises, such as Lehman Brothers and Enron, has cast doubt on the predictive accuracy of their ratings. Empirical studies suggest CRAs’ ratings are inferior predictors of default compared to internal models used by financial institutions.

- Pro-cyclicality: Despite claims of being cycle-independent, ratings of CRAs have been criticized for being overly optimistic during economic booms and pessimistic during downturns, suggesting a pro-cyclical pattern that exacerbates crisis conditions.

- Despite these criticisms, credit ratings issued by CRAs remain crucial components of risk management systems globally. However, they are not the sole determinant in credit risk management decisions. Instead, they complement other approaches and systems, contributing to integrated risk management. While CRAs’ ratings provide valuable insights into systematic risk components affecting credit risk products like credit spreads, they may not fully capture all factors influencing borrower creditworthiness and loan portfolio risk.