Credit Scoring & Retail Credit Risk Management

Instructor Micky Midha

Updated On Learning Objectives

- Analyze the credit risks and other risks generated by retail banking.

- Explain the differences between retail credit risk and corporate credit risk.

- Discuss the “dark side” of retail credit risk and the measures that attempt to address the problem.

- Define and describe credit risk scoring model types, key variables, and applications.

- Discuss the key variables in a mortgage credit assessment, and describe the use of cutoff scores, default rates, and loss rates in a credit scoring model.

- Discuss the measurement and monitoring of a scorecard performance including the use of cumulative accuracy profile (CAP) and the accuracy ratio (AR) techniques.

- Describe the customer relationship cycle, and discuss the trade-off between creditworthiness and profitability.

- Discuss the benefits of risk-based pricing of financial services.

- Video Lecture

- |

- PDFs

- |

- List of chapters

Chapter Contents

- Introduction To Retail Banking

- Retail Versus Corporate Credit Risk

- Dark Side Of Retail Credit Risk

- Credit Scoring Models

- Application Of Credit Scoring Models

- Key Variables In Mortgage Credit Assessment

- From Cutoff Scores To Default Rates And Loss Rates

- Scorecard Performance

- Creditworthiness And Probability

- Customer Relationship Cycle

- Risk Based Pricing

Introduction To Retail Banking

- The Basel Committee defines retail exposures as homogeneous portfolios with numerous small, low-value loans, focusing on either consumers or businesses, with minimal incremental risk per exposure.

- Some of the main products offered are –

- Home Mortgages – These are loans secured by residential properties, including fixed-rate mortgages and adjustable-rate mortgages (ARMs). The loan-to-value ratio (LTV) is a crucial risk factor.

- Home Equity Loans (HELOC) – These are secured by residential properties and can be considered a hybrid between consumer and mortgage loans.

- Installment Loans – This category includes revolving loans like personal lines of credit and credit cards, as well as automobile loans and other loans not covered by the previous categories. They are usually secured by residential or personal property.

- Credit Card Revolving Loans – These are unsecured loans.

- Small Business Loans (SBL) – These loans are typically secured by business assets or personal guarantees from the owners. Business loans up to $100,000 to $200,000 are often part of the retail portfolio.

Retail Versus Corporate Credit Risk

- In retail banking, credit risk is the primary concern, but it operates differently from credit risk in commercial and investment banking.

- Retail credit exposures consist of small, manageable portions, preventing a single customer’s default from posing a significant threat to the bank.

- In contrast, corporate and commercial credit portfolios often contain large exposures to individual names and concentrated exposures to corporations linked within specific geographic areas or industry sectors.

- Under normal market conditions, retail credit portfolios exhibit characteristics of well- diversified portfolios, allowing banks to estimate the expected percentage of the portfolio that might default in the future and the associated losses. This expected loss is treated like a regular cost of doing business and can be factored into customer pricing. However, during economic crises, the benefits of diversification decrease as correlations increase, leading to higher default rates. For instance, the 2007-2009 financial crisis demonstrated how housing prices fell simultaneously across the US economy. Additionally, changes in consumer lending practices, such as providing loans without verifying incomes, can introduce hidden systematic risks into credit portfolios and entire credit industries.

- Apart from credit risk, retail banking is subject to the following risks –

- Interest-rate risk arises from offering specific rates to borrowers and depositors. This risk is managed within the bank’s asset/liability and liquidity risk management.

- Asset valuation risks are a form of market risk, where accurate valuation of assets, liabilities, or collaterals is crucial. Prepayment risk in mortgage banking is particularly significant, as mortgages may lose value when interest rates fall, and customers pay down their loans unexpectedly quickly. Managing prepayment risk can be complex due to uncertainties in customer behavior. Banks tend to centralize management of such risks within their treasury units.

- Operational risks are managed within the respective business areas. For example, fraud by customers is closely monitored, and fraud detection mechanisms are implemented when warranted. Banks allocate regulatory capital for operational risk under Basel II and III regulations, and a subdiscipline of retail operational risk management is emerging.

- Business risks are a primary concern for senior management, encompassing volume risks related to changes in mortgage business due to interest rate fluctuations, strategic risks associated with Internet banking growth or new payment systems, and decisions regarding mergers and acquisitions.

- Reputation risks hold significant importance in retail banking. Banks must uphold their reputation for delivering on promises to customers and maintaining a positive image with regulators, as regulatory dissatisfaction can jeopardize their business franchise.

Dark Side Of Retail Credit Risk

- The dark side of retail credit involves the risk of unexpected losses caused by systematic factors influencing credits in a bank’s portfolio. Four main reasons contribute to this dark side –

- Limited historical loss data for new and innovative credit products.

- Unexpected behavior of well-established credit products due to sudden changes in the economic environment, where multiple risk factors worsen simultaneously. For example, a deep recession and higher interest rates could lead to increased mortgage defaults alongside sharp declines in house prices and collateral values.

- A continuously evolving social and legal system that may encourage defaults. For instance, the growing acceptance of personal bankruptcy, particularly in the United States, contributed to an increase in personal defaults during the 1990s.

- Any operational issues affecting the credit assessment of customers can have a systematic impact on the entire consumer portfolio.

- Assigning a specific risk number to unpredictable wild-card risks is challenging. Therefore, banks aim to minimize vulnerability to such risks in their retail credit portfolios, like subprime lending. While some exposure to uncertainty can lead to profitable ventures and improved risk measurement, excessive exposure can be detrimental.

- For large conventional portfolios like mortgages, banks rely on stress tests to assess the potential impact of worst-case scenarios caused by sharp changes in multiple risk factors.

- In response to the crisis, several industry reforms and regulations, including the Consumer Financial Protection Bureau (CFPB) under the Dodd-Frank Act (DFA), have been established to address the challenges of retail credit risk. For instance, the CFPA mandates that credit originators assess the consumer’s ability to repay a mortgage. If a mortgage qualifies as a “qualified mortgage” (QM), the creditor can assume the borrower meets this requirement. Qualified mortgages possess the following characteristics –

- Absence of excessive upfront points and fees

- Exclusion of toxic loan features, such as negative amortization, loan terms beyond 30 years, and interest-only loans for a specific duration

- A maximum limit on debt-to-income (DTI) ratio, usually set at 43%

- Prohibition of loans with balloon payments

- The CFPA also introduced an “ability to repay” assessment, which prompts lenders to consider underwriting standards, ensuring responsible lending practices. The “ability to repay” requires lenders to assess eight underwriting standards –

- Current employment status

- Current income or assets

- Credit history

- Monthly mortgage payment

- Monthly payments for other loans related to the property

- Monthly payments for mortgage-related obligations, such as property taxes

- Other debt obligations

- The borrower’s monthly debt-to-income (DTI) ratio or residual income with the mortgage.

- Regulators acknowledge that retail credit risk is somewhat predictable, and mortgage loans are considered safer due to their real estate backing. Therefore, retail banks are required to allocate a relatively smaller amount of risk capital under Basel II and III for retail credit compared to corporate loans. However, banks must still provide regulators with probability of default (PD), loss given default (LGD), and exposure at default (EAD) statistics for distinct segments of their portfolios. These segments should be based on credit scores or similar measures, as well as the vintage of exposures, indicating the time transactions have been on the bank’s books.

Credit Scoring Models

- A credit scoring model is a commonly used tool to determine whether a loan should be approved or denied. It is derived from a statistical model that considers various borrower information (e.g., age, previous loan history) to differentiate between “good” and “bad” loans and provide an estimated probability of default.

- The credit scoring model utilizes statistical methods to transform data about a credit applicant or existing account holder into numerical scores. These scores are indicative of the individual’s credit risk, with higher scores representing lower risk.

- Credit scoring plays a crucial role for banks as it helps them identify and avoid the riskiest customers. Additionally, it aids in evaluating the potential profitability of specific businesses by comparing the remaining profit margin after accounting for operating and estimated default expenses subtracted from gross revenues.

- While a credit scoring model is an essential element in assessing a credit application, the final evaluation of a loan primarily relies on the judgment of a credit expert.

- Three types of credit scoring models are used for evaluating consumer credit applications –

- Credit Bureau Scores – These scores, often referred to as FICO scores, are developed by Fair Isaac Corporation and maintained by companies like Equifax and TransUnion. They provide a cost-effective and quick overview of an applicant’s overall creditworthiness, with scores typically ranging from 300 to 850.

- Pooled Models – These models are created by external vendors, like Fair Isaac, using data from multiple lenders with similar credit portfolios. For instance, a revolving credit pooled model might be based on credit card data from various banks. While more expensive than generic scores, they offer industry-specific tailoring without being company-specific.

- Custom Models – Developed in-house, these models use data from a lender’s own unique pool of credit applications. They are tailored to screen for specific applicant profiles for a particular lender’s product. Custom models allow banks to specialize in credit segments, like credit cards or mortgages, offering a competitive advantage in selecting the best customers and providing risk-adjusted pricing.

- Credit bureau data consists of various “credit files” for individuals with a credit history. These files include five main types of information –

- Identifying information – Personal details that are not used in scoring models.

- Public records (legal items) – Information from civil court records, such as bankruptcies, judgments, and tax liens.

- Collection information – Data reported by debt collection agencies or entities that provide credit.

- Trade line/account information – Monthly data on accounts sent by credit grantors to the credit bureaus, including new accounts and updates to existing account information.

- Inquiries – Each time a credit file is accessed, an inquiry is placed on the file. Credit grantors only see inquiries related to the extension of new credit.

- Credit bureaus like Equifax offer individuals the option to access their own credit score and receive guidance on how to enhance it. This may include what-if scenarios, such as the effect of reducing credit card balances on the score. A bureau score can be used as a basis for a comprehensive credit score, considering various important factors like loan-to-value and loan documentation quality.

Application Of Credit Scoring Models

- Credit scoring is crucial for banks as it helps them avoid risky customers and assess the profitability of businesses by analyzing operating costs and estimated default expenses.

- Moreover, credit scoring ensures cost-effectiveness and consistency for major banks with millions of customers and billions of transactions annually. Before credit scoring, credit officers had to manually review applications, leading to inconsistencies due to the vast amount of information involved. Credit scoring automates the process and ensures standardized credit decisions over time.

- Credit risk scorecards use characteristics, which are information items from credit applications or bureau reports. These characteristics have corresponding attributes, like “four years” for “time at address” or “rents” for “residential status”. The models weigh these attributes based on statistical techniques that analyze past repayment performance, calculating population odds (probability of good events vs. bad events). For instance, an applicant with 15:1 odds has a 6.25%

chance of being a bad customer (i.e., delinquent or charged-off).

Key Variables In Mortgage Credit Assessment

During the credit evaluation process, credit originators analyze several key variables –

- Documentation (doc) type –

- Full doc – Proof of income and assets, with calculated debt-to-income ratios.

- Stated income – Employment verification, but income not verified.

- No income/No asset – Applicant states income and assets, which are used as security without verification.

- No ratio – Income not listed, only employment information requested.

- No doc – No documentation required for income or assets; fields may be left blank in the application.

- FICO – A score that quickly assesses an applicant’s creditworthiness.

- DTI – Debt-to-income ratio, which compares monthly debt payments to income, helping determine the applicant’s capacity for another loan.

- LTV – Loan-to-value ratio, representing the loan amount compared to the asset’s value, indicating the level of credit risk.

- Payment type (Pmt) – Identifies the mortgage type, such as adjustable rate or fixed.

From Cutoff Scores To Default Rates And Loss Rates

- During the initial development of credit scoring models, the specific probability of default assigned to each credit applicant was not of great importance. Instead, the models were designed to rank applicants based on their relative risk. Lenders used these models to determine an appropriate cutoff score, which determined whether applicants were accepted or not based on subjective criteria.

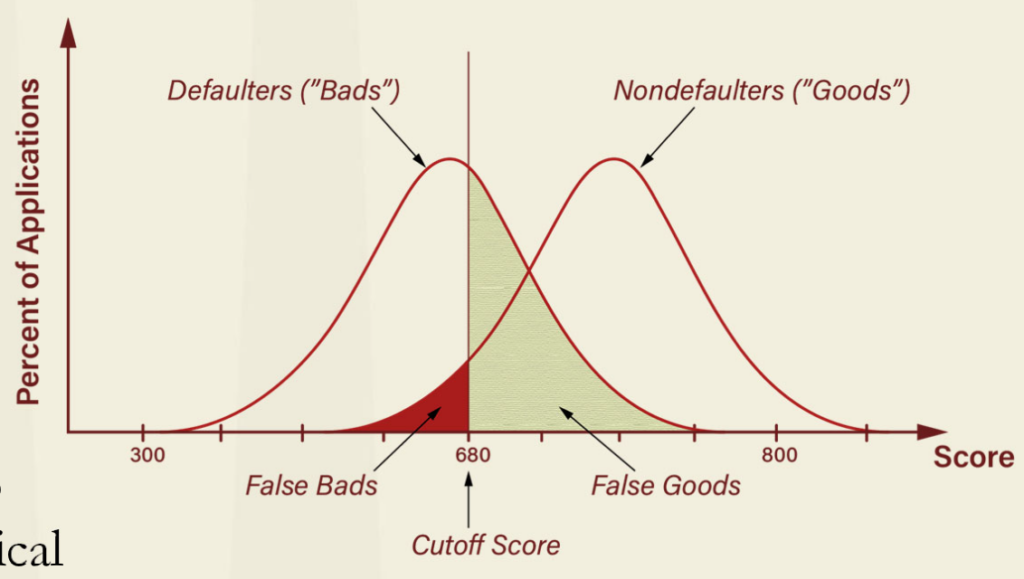

- The distribution of “good” and “bad” accounts by credit score is shown in this figure. If the minimum acceptable score is set at 680 points, only applications scoring that value or higher would be accepted. By doing so, the firm using the scoring system would avoid lending money to the body of bad customers to the left of the vertical line, but would also forgo the smaller body of good accounts to the left of the line. An even higher fraction of bad accounts can be cut off by moving the minimum score line to the right, but this would also forgo a larger fraction of good accounts, and so on. The cutoff score is clearly an important decision for the business in terms of both its likely profitability and the risk that the bank is taking on.

- With the cutoff score established, the bank can analyze its actual experience to determine the loss rate and profitability for the retail product. Over time, the bank can make adjustments to the cutoff score to optimize the profit margin and reduce false goods and false bads. Retail banking, unlike wholesale banking, deals with a large number of customers, allowing for quick data accumulation to assess the scorecard’s performance. However, to capture behavior across a normal economic cycle, longer time series data is necessary. Typically, loss rates and profitability statistics are updated quarterly.

- Under the Basel Capital Accord, banks are required to segment their retail portfolios into sub- portfolios with similar loss characteristics, particularly prepayment risk. By segmenting each retail portfolio by score band, corresponding to different risk levels, the bank can estimate both the Probability of Default (PD) and the Loss Given Default (LGD) for these portfolios. Historical data can be used to estimate the loss rate for each score band, and with an estimate of the LGD, the implied PD can be inferred. For instance, if the historical loss rate is 2 percent with a 50 percent LGD, then the implied PD would be 4 percent.

Scorecard Performance

- The purpose of credit scoring is to predict which applications will be good or bad risks in the future. To achieve this, high scores are assigned to good credits, and low scores to poor ones. The goal of the scorecard is to minimize the overlapping area of the distribution of good and bad credits, as observed in the previous figure.

- Hence, it is crucial to develop tools for evaluating the performance of a scorecard. The commonly used validation technique is the cumulative accuracy profile (CAP) along with its summary statistic, the accuracy ratio (AR), as shown in the given figure.

- In a perfect model, if the bank predicts, for example, a 8% default rate for a specific period, all of those defaults will come from the riskiest 8% of the population. In this case, actual number of accounts that defaulted over that time period would correspond to the first decile of the score distribution – the perfect model line in the figure.

- On the other hand, a random model assumes that 8% of the defaults will come from the riskiest 8%, 15% from the riskiest 15%, and so on. The 45-degree line corresponds to a random model that cannot differentiate between good and bad customers, and it provides no information at all, and that’s why, its completely random.

- The observed cumulative default line reflects the actual defaults observed by the bank. The goal is to develop a model that closely aligns with the perfect model line.

- In a perfect model, if the bank predicts, for example, a 8% default rate for a specific period, all of those defaults will come from the riskiest 8% of the population. In this case, actual number of accounts that defaulted over that time period would correspond to the first decile of the score distribution – the perfect model line in the figure.

- On the other hand, a random model assumes that 8% of the defaults will come from the riskiest 8%, 15% from the riskiest 15%, and so on. The 45-degree line corresponds to a random model that cannot differentiate between good and bad customers, and it provides no information at all, and that’s why, its completely random.

- The observed cumulative default line reflects the actual defaults observed by the bank. The goal is to develop a model that closely aligns with the perfect model line.

- In a perfect model, if the bank predicts, for example, a 8% default rate for a specific period, all of those defaults will come from the riskiest 8% of the population. In this case, actual number of accounts that defaulted over that time period would correspond to the first decile of the score distribution – the perfect model line in the figure.

- On the other hand, a random model assumes that 8% of the defaults will come from the riskiest 8%, 15% from the riskiest 15%, and so on. The 45-degree line corresponds to a random model that cannot differentiate between good and bad customers, and it provides no information at all, and that’s why, its completely random.

- The observed cumulative default line reflects the actual defaults observed by the bank. The goal is to develop a model that closely aligns with the perfect model line.

- In a perfect model, if the bank predicts, for example, a 8% default rate for a specific period, all of those defaults will come from the riskiest 8% of the population. In this case, actual number of accounts that defaulted over that time period would correspond to the first decile of the score distribution – the perfect model line in the figure.

- On the other hand, a random model assumes that 8% of the defaults will come from the riskiest 8%, 15% from the riskiest 15%, and so on. The 45-degree line corresponds to a random model that cannot differentiate between good and bad customers, and it provides no information at all, and that’s why, its completely random.

- The observed cumulative default line reflects the actual defaults observed by the bank. The goal is to develop a model that closely aligns with the perfect model line.

- In a perfect model, if the bank predicts, for example, a 8% default rate for a specific period, all of those defaults will come from the riskiest 8% of the population. In this case, actual number of accounts that defaulted over that time period would correspond to the first decile of the score distribution – the perfect model line in the figure.

- On the other hand, a random model assumes that 8% of the defaults will come from the riskiest 8%, 15% from the riskiest 15%, and so on. The 45-degree line corresponds to a random model that cannot differentiate between good and bad customers, and it provides no information at all, and that’s why, its completely random.

- The observed cumulative default line reflects the actual defaults observed by the bank. The goal is to develop a model that closely aligns with the perfect model line.

- In a perfect model, if the bank predicts, for example, a 8% default rate for a specific period, all of those defaults will come from the riskiest 8% of the population. In this case, actual number of accounts that defaulted over that time period would correspond to the first decile of the score distribution – the perfect model line in the figure.

- On the other hand, a random model assumes that 8% of the defaults will come from the riskiest 8%, 15% from the riskiest 15%, and so on. The 45-degree line corresponds to a random model that cannot differentiate between good and bad customers, and it provides no information at all, and that’s why, its completely random.

- The observed cumulative default line reflects the actual defaults observed by the bank. The goal is to develop a model that closely aligns with the perfect model line.

- The area between the perfect model and the random model is denoted by \(A_P\), while the area between the observed cumulative default percentage line and the random line is denoted by \(A_R\). The accuracy ratio (AR) is calculated as \(A_R\)/\(A_P\), with a ratio close to 1 indicating a more accurate model.

- Regular monitoring of the scoring model is essential due to potential changes in the population and product variations.

Creditworthiness And Probability

- There is often a trade-off between customer creditworthiness and their profitability.

- For instance, issuing costly credit cards to highly creditworthy customers who rarely use them may not be beneficial. Similarly, if a customer with an exceptionally high FICO score, pays their bill in full every month, the bank will not earn any interest from that customer on borrowed funds.

- On the other hand, customers with slightly higher default risk might still be more profitable, especially if they borrow frequently or accept higher interest rates. However, it’s crucial to assess whether the additional profitability truly outweighs the risks in the long term, particularly if the economy faces downturns that could affect the default rate for slightly less creditworthy customers.

- In the past, lenders primarily focused on assessing default risk, but they have since adopted more nuanced approaches directly related to a customer’s value to the bank. Credit scoring techniques have expanded to various areas, including

- Response scorecards that predict a consumer’s likelihood to respond to a direct marketing offer,

- Usage scorecards that estimate how likely a customer will utilize a credit product, and

- Attrition scorecards that forecast how long a customer will stay loyal to the lender.

As a result, each customer may now be characterized by multiple different scores.

- Leading banks are exploring new methods to consider the intricate balance between risk and reward. Instead of relying solely on traditional credit default scoring, they are adopting

- Product profit scoring, which aims to estimate the profit that the lender generates from a specific product based on the customers usage, and

- Customer profit scoring, which attempts to gauge the overall profitability of the customer to the lender across various products and interactions.

- These advanced approaches help lenders determine credit limits, interest margins, and other product features to maximize customer profitability. Additionally, banks can adjust various parameters throughout their relationship with the customer to optimize results.

- Apart from credit bureau scores, banks can utilize various other scorecards to assess and make decisions related to credit applications and existing customers’ profitability:

- Application scores help in making the initial decision to approve or reject a new credit applicant.

- Behavior scores are risk estimators similar to application scores, but they utilize data on the behavior of existing credit account holders, including credit usage and delinquency history.

- Revenue scores are designed to forecast the profitability of existing customers.

- Response scores predict the probability of a customer responding to an offer or promotion.

- Attrition scores estimate the likelihood of existing customers closing their accounts, not renewing credit products (e.g., mortgages), or reducing their credit balances.

- Insurance scores predict the probability of insurance claims from insured parties.

- Tax authority scores predict which individuals the tax inspector should audit to collect additional revenues.

Customer Relationship Cycle

- Banks follow a customer relationship cycle with three stages – marketing initiatives, screening for approval, and account management.

- Marketing initiatives involve targeting both new and existing customers with new or tailored products that align with their specific needs. These initiatives are based on in-depth marketing studies, which analyze the likely response of different client segments.

- Screening applicants involves using scorecards to determine which applications to accept or reject. This process includes granting the initial credit line and setting appropriate pricing based on the client’s risk level.

- Managing the account is an ongoing process that entails making decisions based on past behavior and activities. These decisions may involve adjusting the credit line or product pricing, authorizing temporary credit line increases, renewing credit lines, and collecting overdue interest and principal on delinquent accounts.

- Cross-selling initiatives complete the customer relationship cycle. By leveraging detailed knowledge of existing customers, the bank can encourage them to purchase additional retail products. For instance, customers with checking and savings accounts may be offered mortgages, credit cards, insurance products, and more. In this retail relationship cycle, risk management plays a vital role in the broader business decision-making process.

- Since the 2007-2009 financial crisis, two significant trends have emerged to improve credit scoring and its application. Firstly, there is a greater focus on understanding how macroeconomic factors impact score bands, adjusting predicted default rates accordingly. This helps with stress testing retail credit risk portfolios in various economic scenarios. The goal is to make business decisions more forward-looking, factoring in baseline economic projections, capital costs, and potential losses in adverse scenarios. Secondly, firms are closely monitoring responses to product variations and early performance of retail offers, such as credit cards. Lessons from these exercises inform marketing campaigns, taking into account capital costs and risk-adjusted profitability. These trends aim to enhance risk-adjusted decision-making in retail banking, making it more responsive to social and economic changes, rather than relying solely on historical data.

Risk Based Pricing

- In general, the market is adopting “risk-based pricing” (RBP) for credit products, where customers with varying risk profiles are charged different amounts for the same product. Banks now recognize that a uniform pricing approach can lead to adverse selection, attracting high-risk customers and discouraging low-risk ones. The true impact of adverse selection may only surface during economic downturns. Leading financial institutions have adopted RBP for acquisitions in auto loans, credit cards, and home mortgages. However, considering longer- term considerations, RBP is still in its early stages in the financial retail area.

- The interest rates and prices charged by lenders are influenced by several key external and internal factors, which account for risk. These factors include –

- operating expenses,

- probability of take-up,

- default probability,

- loss given default,

- exposure at default,

- allocated capital, and

- cost of equity capital.

- A bank’s key business objectives are often not adequately reflected in its pricing strategy. Pricing low-balance accounts versus high-balance revolvers is a challenge, and cutoff scores and tiered pricing are often based on heuristics rather than pragmatic analytics. Implementing a well-designed RBP strategy allows the bank to map alternative pricing strategies to key corporate metrics and is essential for effective retail management. RBP takes into account essential factors from both external market data, such as the probability of take-up, which depends on price and credit limit, and internal data, like the cost of capital.

- RBP allows retail banks to optimize shareholder value by achieving management objectives while considering multiple constraints like profit, market share, and risk. Mathematical programming algorithms efficiently achieve these objectives. Pricing is a key tool for retail bankers in balancing market share and reducing bad accounts. To increase market share while managing risk, a retail bank may analyze bad account rates based on the acceptance rate of the overall population (strategy curve). Improved pricing can significantly enhance corporate performance metrics by 10 to 20 percent or more.

- RBP is also valuable for nonbanks offering credit to customers and small businesses. However, many retailers lack the necessary logistical and operational infrastructure, leading them to rely more on credit card payments and payments backed by financial institutions.