Financial Co-relation Modeling — Bottom-Up Approaches

Learning Objectives

- Explain the purpose of copula functions and the translation of the copula equation.

- Describe the Gaussian copula and explain how to use it to derive the joint probability of default of two assets.

- Summarize the process of finding the default time of an asset correlated to all other assets in a portfolio using the Gaussian copula.

- Video Lecture

- |

- PDFs

- |

- List of chapters

Introduction

- A fairly recent and famous as well as infamous correlation approach applied in finance is the copula approach.

- When flexible copula functions were introduced to finance in 2000, they were enthusiastically embraced but then fell into disgrace when the global financial crisis hit in 2007.

- Copulas became popular because they could presumably solve a complex problem in an easy way: It was assumed that copulas could correlate multiple assets, for example the 125 assets in a CDO, with a single (although multidimensional) function.

- There are benefits and limitations of the Gaussian copula for valuing CDOs.

Copula Correlations

- Copula functions are designed to simplify statistical problems. They allow the joining of multiple univariate distributions to a single multivariate distribution. Formally, a copula function C transforms an n-dimensional function on the interval [0, 1] into a unit-dimensional one:

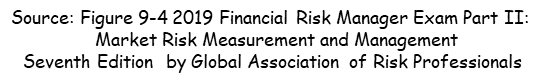

More generally, let 𝐺i 𝑢i 𝜖[0,1] be a univariate, uniform distribution with 𝑢i = 𝑢1 ….. 𝑢n, and

𝑖 𝜖 𝑁. Then there exists a copula function C such that

where 𝐺i 𝑢i are called marginal distributions, 𝐹n is the joint cumulative distribution function 𝐹–1 is the inverse of 𝐹i, and 𝜌F is the correlation structure of 𝐹n.

where 𝐺i 𝑢i are called marginal distributions, 𝐹n is the joint cumulative distribution function 𝐹–1 is the inverse of 𝐹i, and 𝜌F is the correlation structure of 𝐹n.

This equation can be read as :

Given are the marginal distributions 𝐺1 𝑢1 𝑡𝑜 𝐺n 𝑢n .

There exists a copula function that allows the mapping of the marginal distributions 𝐺1 𝑢1 𝑡𝑜 𝐺n 𝑢n via 𝐹–1 and the joining of the (abscise values) 𝐹–1(𝐺i(𝑢i)) to a single, n-variate function 𝐹n 𝐹–1 𝐺1 𝑢1 …., 𝐹–1 𝐺n 𝑢n with correlation structure of 𝜌F.

If the mapped values 𝐹–1 𝐺i 𝑢i are continuous, it follows that 𝐶 is unique.

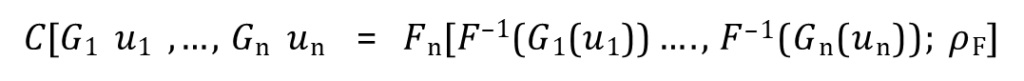

Types of Copula Function

- Numerous types of copula functions exist. They can be broadly categorized in one-parameter copulas as the Gaussian copula and the Archimedean copula family, the most popular being Gumbel, Clayton, and Frank copulas. Often cited two-parameter copulas are Student’s t, Frechet, and Marshall-Olkin. This figure shows an overview of popular copula functions.

The Gaussian Copula

- Due to its convenient properties, the Gaussian copula 𝐶G is among the most applied copulas in finance. In the n-variate case, it is defined

𝐶G [𝐺1(𝑢1),…., 𝐺n(𝑢n)] = 𝑀n[𝑁–1(𝐺1(𝑢1)), … , 𝑁–1(𝐺n(𝑢n)); 𝜌M]

where

𝑀n is the joint, 𝑛-variate cumulative standard normal distribution

𝜌M, the 𝑛× 𝑛 symmetric, positive-definite correlation matrix of the n-variate normal distribution 𝑀n.

𝑁–1 𝑖𝑠 the inverse of a univariate standard normal distribution.

If the 𝐺x(𝑢x) are uniform, then the 𝑁–1(𝐺x(𝑢x)) are standard normal and 𝑀n is standard multivariate normal.

- It was David Li (2000) who transferred the Gaussian copula approach to finance. He defined the cumulative default probabilities 𝑄 for entity 𝑖 at a fixed time 𝑡, 𝑄(𝑡) as marginal distributions. Hence, the Gaussian default time copula 𝐶GD can be derived as

This equation reads: Given are the marginal distributions, that is, the cumulative default probabilities 𝑄 of entities 𝑖 = 1 to 𝑛 at times 𝑡, 𝑄i(𝑡). There exists a Gaussian copula function

𝐶GD, which allows the mapping of the marginal distributions 𝑄i 𝑡 via 𝑁–1 to standard normal

and the joining of the (abscise values) 𝑁–1𝑄i(𝑡) to a single 𝑛-variate standard normal distribution 𝑀n with the correlation structure 𝜌M.

More precisely, the term 𝑁–1 maps the cumulative default probabilities 𝑄 of asset 𝑖 for time 𝑡, 𝑄i(𝑡), percentile to percentile a univariate standard normal distribution. So the 5th percentile of 𝑄i(𝑡) is mapped to the 5th percentile of the standard normal distribution, the 10th percentile of 𝑄i(𝑡) is mapped to the 10th percentile of the standard normal distribution, and so forth. As a result, the 𝑁–1(𝑄i 𝑡 ) in the above equation are abscise (x-axis) values of the standard normal distribution. The 𝑁–1(𝑄i(𝑡)) are then joined to a single 𝑛-variate distribution 𝑀n by applying the correlation structure of the multivariate normal distribution with correlation matrix 𝜌M. The probability of 𝑛 correlated defaults at time 𝑡 is given by 𝑀n.

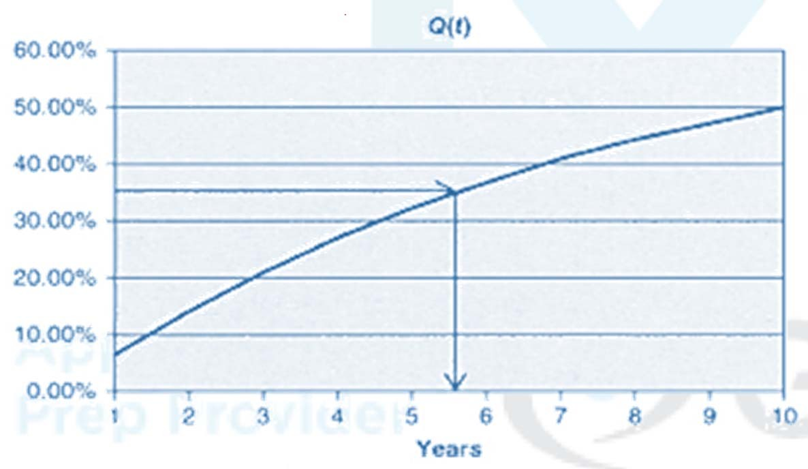

- Graphically the mapping 𝑁–1(𝑄(𝑡)) can be represented in two steps, which are displayed in this figure. In the lower graph, the cumulative default probability of company 𝐵, 𝑄B 𝑡 , is displayed. First, these cumulative probabilities are mapped percentile to percentile to a cumulative standard normal distribution in the upper graph (up arrows). In a second step the abscise (x-axis) values of the cumulative normal distribution are found (down arrows).

- The same mapping procedure is done for company 𝐶𝑎𝑎; the cumulative default probabilities of company 𝐶𝑎𝑎 , are mapped percentile to percentile to a cumulative standard normal distribution via 𝑁–1(𝑄Caa(𝑡)).

- Importantly, the copula model now assumes that we can apply the correlation structure 𝜌M or a single 𝜌 of the multivariate distribution (in our case the Gaussian multivariate distribution M) to the transformed marginal distributions 𝑁–1(𝑄B(𝑡)) 𝑎𝑛𝑑 𝑁–1(𝑄Caa(𝑡)). This is done for mathematical and computational convenience.

Now the joint default probabilities of the companies 𝐵 and 𝐶𝑎𝑎 can be found out by using the bivariate cumulative distribution

For example,

The joint default probability 𝑄 of companies 𝐵 and 𝐶𝑎𝑎 in the next year assuming a one-year Gaussian default correlation of 0.4 is:

𝑄 𝑡B ≤ 1 ∩ 𝑡caa ≤ 1 ≡ 𝑀(𝑥B ≤ —1.5133 ∩ 𝑥caa ≤ —0.7118, 𝜌 = 0.4) = 3.44%

where 𝑡B is the default time of company Band 𝑡caa is the default time of company Caa. 𝑥B and 𝑥caa are the mapped abscise values of the bivariate normal distribution.

Another example –

The joint probability of company 𝐵 defaulting in year 3 and company 𝐶𝑎𝑎 defaulting in year 5 is

𝑄 𝑡B ≤ 3 ∩ 𝑡caa ≤ 5 ≡ 𝑀(𝑥B ≤ —0.8054 ∩ 𝑥caa ≤ —0.2557, 𝜌 = 0.4) = 16.93%

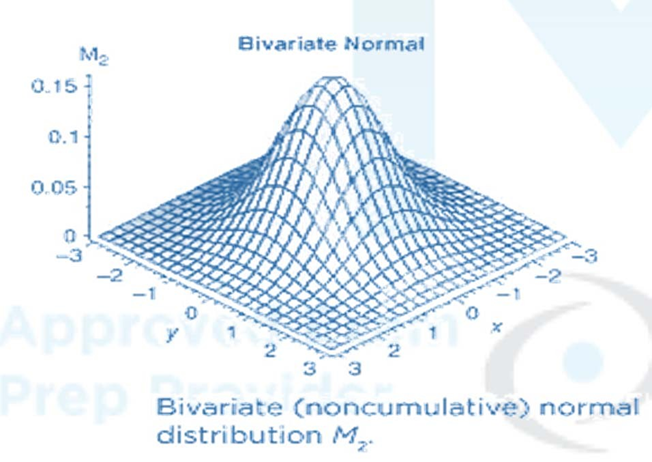

The bivariate normal distribution 𝑀2 is displayed in this figure.

The code for the bivariate cumulative normal distribution M can be found on the Internet

The Gaussian Copula-Example

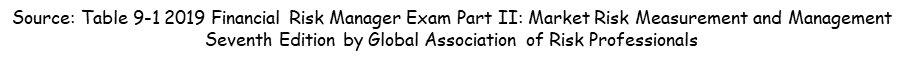

- Let’s assume we have two companies, 𝐵 and 𝐶𝑎𝑎, with their estimated default probabilities for year 1 to 10 as displayed in this table. Default probabilities for investment grade companies typically increase in time, since uncertainty increases with time. However, in this table, there are two companies currently in distress. For these companies the next few years will be the most difficult. If they survive these next years, their default probability will decrease.

| Default Time t | Company B Default Probability | Company B Cumulative Default Probability \(Q_B(t)\) | Company Caa Default Probability | Company Caa Cumulative Default Probability (Q_{Caa}(t) |

|---|---|---|---|---|

| 1 | 6.51% | 6.51% | 23.83% | 23.83% |

| 2 | 7.65% | 14.16% | 13.29% | 37.12% |

| 3 | 6.87% | 21.03% | 10.31% | 47.43% |

| 4 | 6.01% | 27.04% | 7.62% | 55.05% |

| 5 | 5.27% | 32.31% | 5.04% | 60.09% |

| 6 | 4.42% | 36.73% | 5.13% | 65.22% |

| 7 | 4.24% | 40.97% | 4.04% | 69.26% |

| 8 | 3.36% | 44.33% | 4.62% | 73.88% |

| 9 | 2.84% | 47.17% | 2.62% | 76.50% |

| 10 | 2.84% | 50.01% | 2.04% | 78.54% |

Let’s now find the joint default probabilities of the companies 𝐵and 𝐶𝑎𝑎 for any time 𝑡 with the Gaussian copula function , First the cumulative default probabilities 𝑄 𝑡 (which are in columns 3 and 5 in this table) are mapped to the standard normal distribution via 𝑁–1(𝑄(𝑡)).

Let’s now find the joint default probabilities of the companies 𝐵and 𝐶𝑎𝑎 for any time 𝑡 with the Gaussian copula function , First the cumulative default probabilities 𝑄 𝑡 (which are in columns 3 and 5 in this table) are mapped to the standard normal distribution via 𝑁–1(𝑄(𝑡)).

- The percentile to percentile mapped cumulative default probability values of our companies to cumulative standard normal distribution (𝑁–1(𝑄B(𝑡)) and 𝑁–1(𝑄caa(𝑡))) are displayed in this table, columns 3 and 5. Since 𝑛 = 2 companies in our example, we can write

| Default Time \(t\) | Company B Cumulative Default Probability \(Q_B(t)\) | Company B Cumulative Standard Normal Percentiles \(N^{-1}(Q_B(t))\) | Company Caa Cumulative Default Probability \(Q_{Caa}(t)\) | Company Caa Cumulative Standard Normal Percentiles \(N^{-1}(Q_{Caa}(t))\) |

|---|---|---|---|---|

| 1 | 6.51% | -1.5133 | 23.83% | -0.7118 |

| 2 | 14.16% | -1.0732 | 37.12% | -0.3287 |

| 3 | 21.03% | -0.8054 | 47.43% | -0.0645 |

| 4 | 27.04% | -0.6116 | 55.05% | 0.1269 |

| 5 | 32.31% | -0.4590 | 60.09% | 0.2557 |

| 6 | 36.73% | -0.3390 | 65.22% | 0.3913 |

| 7 | 40.97% | -0.2283 | 69.26% | 0.5032 |

| 8 | 44.33% | -0.1426 | 73.88% | 0.6397 |

| 9 | 47.17% | -0.0710 | 76.50% | 0.7225 |

| 10 | 50.01% | 0.0003 | 78.54% | 0.7906 |

Simulating the Correlated Default Time for Multiple Assets

•To derive the default time of asset 𝑖, 𝜏i, which is correlated to the default times of all other assets 𝑖 = 1, … , 𝑛 , first, a sample 𝑀n · from a multivariate copula is derived, where 𝑀n (·) 𝜖 [0,1] . This is done via Cholesky decomposition. The sample includes the default correlation via the default correlation matrix 𝜌M of the 𝑛-variate standard normal distribution 𝑀n. Then the sample(·) from 𝑀n (which is 𝑀n(·)) is equated with the cumulative individual default probability 𝑄 of asset 𝑖 at time 𝜏, 𝑄i(𝜏i). Therefore,

•There is no closed-form solution for the above equations. To find the solution, a search procedure such as Newton-Raphson can be used. It can also be done use a simple lookup function in Excel.

•Let’s assume the random drawing from 𝑀n(·) was 35%. Now 35% is equated with the market given function 𝑄i(𝜏i) and the expected default time 𝜏i of asset 𝑖, is found out. This is displayed in this figure, where 𝜏i = 5.5 years. This procedure is repeated numerous times, for example 100,000 times, and each 𝜏i of every simulation is averaged to obtain the estimate for 𝜏i Importantly, the estimated default time 𝜏i of asset 𝑖, includes the default correlation with the other assets in the portfolio, since the correlation matrix is an input of the 𝑛-variate standard normal distribution 𝑀n.