Netting, Close-Out And Related Aspects

Learning Objectives

- Explain the purpose of an ISDA master agreement.

- Summarize netting and close-out procedures (including multilateral netting), explain their advantages and disadvantages, and describe how they fit into the framework of the ISDA master agreement.

- Describe the effectiveness of netting in reducing credit exposure under various scenarios.

- Describe the mechanics of termination provisions and trade compressions and explain their advantages and disadvantages.

- Identify and describe termination events and discuss their potential effect on parties to a transaction.

- Video Lecture

- |

- PDFs

- |

- List of chapters

Chapter Contents

- The Need For Netting And Close-Out

- The Need For Netting And Close-Out – Example

- Payment and Close-Out Setting

- The ISDA Master Agreement

- Events of Default

- Payment Netting

- Default, Netting And Close-Out (A)

- Close-Out Netting

- Product Coverage And Set-Off Rights

- Close-Out Amount

- The Impact Of Netting

- Default, Netting And Close-Out (B)

- Multilateral Netting And Trade Compression: Overview

- Multilateral Netting

- Bilateral Compression Services

- The Need For Standardization

- Default, Netting And Close-Out-Examples

- Termination Features And Resets

- Walkaway Features

- Termination Events

- Reset Agreements

The Need For Netting And Close-Out

- OTC derivatives markets are fast-moving, with some participants (e.g. banks and hedge funds) regularly changing their positions.

- Derivative portfolios may contain a large numbers of transactions, which may partially offset (hedge) one another. These transactions may themselves require contractual exchange of cashflows and/or assets through time. These would ideally be simplified into a single payment wherever possible (netting).

- A given party may have hundreds or even thousands of separate derivatives transactions with that counterparty. They need a mechanism to terminate their transactions rapidly and replace (rehedge) their overall position. It is desirable for a party to be able to offset what it owes to the defaulted counterparty against what they themselves are owed.

The Need For Netting And Close-Out – Example

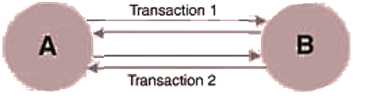

- Consider the situation illustrated in this figure. Suppose parties A and B trade bilaterally and have two transactions with one another, each with its own set of cashflows. This situation is potentially over-complex for two reasons:

- Cashflows. Parties A and B are exchanging cashflows or assets on a periodic basis in relation to transaction 1 and transaction 2. However, where equivalent cashflows occur on the same day, this requires exchange of gross amounts, giving rise to settlement risk. It would be preferable to amalgamate payments and exchange only a net amount

- Close-out. In the event that either party A or B defaults, the surviving party may suffer from being responsible for one transaction that has moved against them but not be paid for the other transaction that may be in their favor. This can lead to uncertainty over cashflow payments or the ability to replace the transactions with another counterparty. Recent years have highlighted the need for risk mitigants for OTC derivatives. For example, the Lehman Brothers bankruptcy led to extensive litigation in relation to the ability to offset different obligations and the valuation of OTC derivative assets or liabilities.

This illustrates the importance of documentation in defining the processes that will occur in the event of a counterparty default.

Payment and Close-Out Setting

- Bilateral OTC derivatives markets have historically developed netting methods whereby parties can offset what they owe to one another. The following two mechanisms facilitate this

- Payment netting. This gives a party the ability to net cashflows occurring on the same day sometimes even if they are in different currencies. This typically relates to settlement risk.

- Close-out netting. This allows the termination of all contracts between an insolvent and a solvent counterparty, together with the offsetting of all transaction values (both in a party’s favor and against it). This typically relates to counterparty risk.

- Netting legislation covering derivatives has been adopted in most countries with major financial markets. The International Swaps and Derivatives Association (ISDA) has obtained legal opinions supporting the close-out and netting provisions in their Master Agreements in most relevant jurisdictions. Currently they have such opinion covering 54 jurisdictions. Thirty-seven countries have legislation that provides explicitly for the enforceability of netting. However, jurisdictions remain where netting is not clearly enforceable in a default scenario.

The ISDA Master Agreement

- The rapid development of the OTC derivative market could not have occurred without the development of standard documentation to increase efficiency and reduce aspects such as counterparty risk. ISDA is a trade organisation for OTC derivatives practitioners. The market standard for OTC derivative documentation is the ISDA Master Agreement, which was first introduced in 1985 and is now used by the majority of market participants to document their OTC derivative transactions.

- The ISDA Master Agreement is a bilateral framework that contains terms and conditions to govern OTC derivative transactions. Multiple transactions will be covered under a general Master Agreement to form a single legal contract of an indefinite term, covering many or all of the transactions. The Agreement comprises a common core section and a schedule containing adjustable terms to be agreed by both parties. This specifies the contractual terms with respect to aspects such as netting, collateral, termination events, definition of default and the close-out process. By doing this, it aims to remove legal uncertainties and to provide mechanisms for mitigating counterparty risk. The commercial terms of individual transactions are documented in a trade confirmation, which references the Master Agreement for the more general terms. Negotiation of the agreement can take considerable time but once it has been completed, trading tends to occur without the need to update or change any general aspects. Typically, English or New York law is applied, although other jurisdictions are sometimes used.

- From a counterparty risk perspective, the ISDA Master Agreement has the following risk mitigating features:

- the contractual terms regarding the posting of collateral (covered in detail in the next chapter);

- events of default and termination;

- all transactions referenced are combined into a single net obligation; and

- the mechanics around the close-out process are defined.

Events of Default

- In relation to counterparty risk, default events lead to the termination of transactions before their original maturity date and the initiation of a close-out process. Events of default covered in the ISDA Master Agreement are:

- failure to pay or deliver;

- breach of agreement;

- credit support default;

- misrepresentation;

- default under specified transaction;

- cross default;

- bankruptcy; and

- merger without assumption.

- The most common of the above are failure to pay (subject to some defined threshold amount) and bankruptcy.

Payment Netting

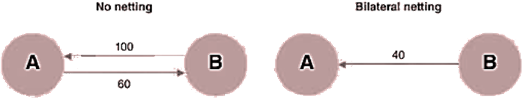

- Payment netting involves the netting of payments between two counterparties in the same currency and in respect of the same transaction, for example netting the fixed and floating interest rate swap payments due on a particular day. For example, if on a particular day an IRS has a fixed payment of 60 by party A to party B and a floating payment of 100 by party B to party A, then payment netting means party B pays party A 40 (as shown in this figure). Parties may also elect to net payments across multiple transaction payments on the same day and in the same currency. This further reduces settlement risk and operational workload.

- Settlement risk is also significant in FX markets where settlement of a contract involves a payment of one currency against receiving the other. It is inconvenient or impossible to settle the currencies on a net basis. To reduce FX settlement risk, banks established Continuous Linked Settlement (CLS) in 2002. For example, Bank A may deliver €100 million to CLS and Bank B delivers $125 million to CLS. When both deliveries arrive, CLS then make the payments to A and B. This is called payment versus payment (PVP). Parties still make the intended cashflows, but CLS ensures that one cannot occur without the other (which is a risk if one counterparty defaults). The settlement obligations are also reduced through multilateral netting between members.

Default, Netting And Close-Out (A)

- Payment netting would appear to be a simple process that gives the maximum reduction of any risk arising from payments made on the same day. However, it does leave operational risk, which was illustrated in a high-profile case during the financial crisis (given below).

CASE STUDY: KFW BANKENGRUPPE (“GERMANY’S DUMBEST BANK”)

- As the problems surrounding Lehman Brothers developed, most counterparties stopped doing business with the bank. However, government-owned German bank KFW Bankengruppe made what they described as an “automated transfer” of €300m to Lehman Brothers literally hours before the latter’s bankruptcy. This provoked an outcry, with one German newspaper calling KFW “Germany’s dumbest bank”. Two of the bank’s management board members (one of whom has since successfully sued the bank for his subsequent dismissal) and the head of the risk-control department were suspended in the aftermath of the “mistake”.

- The above transaction was a regular cross-currency swap with EUR being paid to Lehman and USD paid back to KFW. On the day Lehman declared bankruptcy, KFW made an automated transfer of €300m despite the fact that Lehman Brothers would not be making the opposite USD payment. Nowadays this type of cross-currency swap could be safely settled via CLS. If KFW had withheld the payment, this may have been challenged by Lehman Brothers.

Close-Out Netting

- As stated, it is not uncommon to have many different OTC derivative transactions with an individual counterparty. Such transactions may be simple or complex, and may cover a small or wider range of products across different asset classes. Furthermore, transactions may fall into one of the following three categories (especially from the point of view of banks):

- They may constitute hedges (or partial hedges) so that their values should naturally move in opposite directions.

- They may reflect unwinds in that, rather than cancelling a transaction, the reverse transaction may have been executed. Hence two transaction with a counterparty may have equal and opposite values, to reflect the fact that the original transaction has been cancelled.

- They may be largely independent, e.g. from different asset classes or on different underlying’s.

- During bankruptcy proceedings, potential counterparty risk losses are compounded by the uncertainty regarding the termination of the proceedings. A creditor who holds an insolvent firm’s debt has a known exposure, and even though the eventual recovery is uncertain, it can be estimated and capped. However, this is not the case for derivatives, where constant rebalancing is typically required to maintain hedged positions. Furthermore, once a counterparty is in default, cashflows will cease and a surviving party will be likely to want or need to execute new replacement contracts.

- While payment netting reduces settlement risk, close-out netting is relevant to counterparty risk since it reduces pre-settlement risk. Close-out netting comes into force in the event that a counterparty defaults and aims to allow a timely termination and settlement of the net value of all transactions with that counterparty. Essentially, this consists of two components:

- Close-out. The right to terminate transactions with the defaulted counterparty and cease any contractual payments.

- Netting. The right to offset the value across transactions and determine a net balance, which is the sum of positive and negative values, for the final close-out amount.

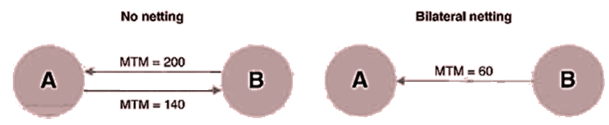

- Close-out netting permits the immediate termination of all contracts with a defaulted counterparty and the settlement of a net amount reflecting the total value of the portfolio. In essence, with closeout netting, all covered transactions (of any maturity, whether in- or out-of-the-money) collapse to a single net value. If the surviving party owes money then it makes this payment; if it is owed money then it makes a bankruptcy claim for that amount. Close-out netting allows the surviving institution to immediately realize gains on transactions against losses on other transactions and effectively jump the bankruptcy queue for all but its net exposure, as illustrated in this Figure 10-3. Close-out netting is general since it only depends on mark-to-market (MTM) values at the time of default and not matching cashflows.

Illustration of the impact of close-out netting. In the event of the default of party A, without netting, party B would need to pay 200 to party A and would not receive the full amount of 140 owed. With netting, party B would simply pay 60 to party A and suffer no loss.

- Netting is not just important to reduce exposure but also to reduce the complexity involved in the close-out of transactions in case the counterparty defaults. In OTC derivatives markets, surviving parties will usually attempt to replace defaulted transactions. Without netting, the total number of transactions and their notional value that surviving parties would attempt to replace may be larger – and hence may be more likely to cause market disturbances

Product Coverage And Set-Off Rights

- There are considerable legal and other operational risks introduced by netting. Some institutions trade many financial products such as loans and repos as well as interest rate, foreign exchange, commodity, equity and credit products. Legal issues regarding the enforceability of netting arise due to transactions being booked with various different legal entities across different regions.

- Bilateral netting is generally recognized for OTC derivatives, repo-style transactions and on-balance-sheet loans and deposits. Cross-product netting is typically possible within one of these categories (for example, between interest rate and foreign exchange transactions). However, netting across these product categories (for example, OTC derivatives and repos) is not straightforward as they are documented differently.

- There is a concept of “set-off” that is similar to close-out netting and involves obligations between two parties being offset to create an obligation that represents the difference. Typically, set-off relates to actual obligations, while close-out netting refers only to a calculated amount. Set-off can be treated differently in different jurisdictions but is sometimes used interchangeably with the term “close-out netting”. Set-off may therefore potentially be applied to offsetting amounts from other agreements against an ISDA close-out amount representing OTC derivatives. One obviously relevant example for banks is when both a loan and a derivative are executed with the same counterparty. This is most often the case where, for However, example, a bank lends money to a counterparty under a loan agreement and then hedges the interest rate risk associated with the loan via an interest rate swap (with terms linked to those of he loan) to effectively create a fixed rate loan.

- Under the 2002 ISDA Master Agreement, a standard setoff provision is included that would allow for offset of any termination payment due against amounts owing to that party under other agreements (for example a loan master agreement, if the relevant loan documentation permits this). It is therefore possible from a legal perspective to set-off derivatives against other products such as loans. However, this will depend on the precise wording of the different sets of documentation, legal entities involved and legal interpretation in the relevant jurisdiction. Some banks have investigated set-off between contracts such as loans and derivatives in order to reduce exposure and CVA (and potentially CVA capital), but this is not standard market practice.

Close-Out Amount

- The close-out amount represents the amount that is owed by one party to another in a default scenario. If this amount is positive from the point of view of the non-defaulting party, then they will have a claim on the estate of the defaulting party. If it is negative, then they will be obliged to pay this amount to the defaulting party. The defaulting party will be unable to pay any claim in full, but establishing the size of the claim is important.

- The determination of the close-out amount is complex because parties will inevitably disagree.

- The non-defaulting party will likely consider their value of executing replacement transactions (“replacement cost”) as the economically correct close-out amount.

- The defaulting party is unlikely to agree with this assessment, since it will reflect charges such as bid-offer costs that it does not experience.

- “Market Quotation” was developed to define the close-out amount, as in the 1992 ISDA Master Agreement with an alternative known as the “loss method”. These are characterized as follows:

- Market quotation. The determining (non-defaulting) party obtains a minimum of three quotes from market makers and uses the average of these quotations to determine the close-out amount. This requires liquidity in the market for those particular transactions. Such liquidity may not exist, especially after a major default (e.g. Lehman Brothers) and in more exotic or non-standard products. Hence it has been sometimes problematic to find market-makers willing to price complex transactions realistically following a major default.

- Loss method. This is used when it is difficult for the determining party to achieve the minimum three quotes required by market quotation for all relevant transactions. The determining party is required to calculate its loss in good faith and using reasonable assumptions. This gives a large amount of discretion to the determining party and introduces major subjectivity into the process.

- Market quotation generally works well for non-complex transactions in relatively stable market conditions. However, since 1992 there have been an increasing number of more complex and structured OTC derivative transactions. This led to a number of significant disputes in the determination of the market quotation amount. Furthermore, the loss method was viewed as too subjective and as giving too much discretion to the determining party. This was further complicated by contradictory decisions made by the English and US courts. Because of these problems and market developments (such as the availability of more external pricing sources), the 2002 ISDA Master Agreement replaced the concepts of market quotation and loss method with a single definition of “close-out amount“ to offer greater flexibility to the determining party, and to address some of the practical problems in achieving market quotations for complex products during market stress. Close-out amounts are a diluted form of market quotation as they do not require actual tradable quotes but can instead rely on indicative quotations, public sources of prices and market data, and internal models to arrive at a commercially reasonable price. In addition, the determining party’s own creditworthiness may be taken into consideration and costs of funding and hedging may be included.

- In summary, market quotation is an objective approach that uses actual firm quotes from external parties. The loss method is more flexible, with the determining party choosing any reasonable approach to determine its loss or gain. The close-out amount method is somewhere in between, giving the determining party flexibility to choose its approach but aiming to ensure that such an approach is commercially reasonable. After the financial crisis, there has been a growing trend towards using the 2002 close-out amount definition. In 2009, ISDA published a close-out amount protocol to provide parties with an efficient way to amend older Agreements to close-out amount with only one signed document rather than changing bilateral documentation on a counterparty by-counterparty basis.

The Impact Of Netting

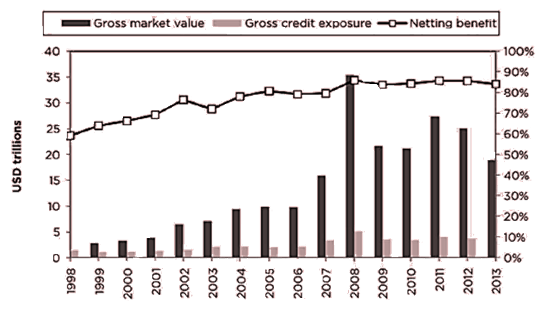

- Close-out netting is the single biggest risk mitigant for counterparty risk and has been critical for the growth of the OTC derivatives market. Without netting, the current size and liquidity of the OTC derivatives market would be unlikely to exist. Netting means that the overall credit exposure in the market grows at a lower rate than the notional growth of the market itself. Netting has also been recognized (at least partially) in regulatory capital rules, which was also an important aspect in allowing banks to grow their OTC derivative businesses. The expansion and greater concentration of derivatives markets has increased the extent of netting steadily over the last decade such that netting currently reduces exposure by close to 90%. However, netted positions are inherently more volatile than their underlying gross positions, which can create systemic risk.

Illustration of the impact of netting on OTC derivatives exposure. The netting benefit (right hand y-axis) is defined by dividing the gross credit exposure by the gross market value and subtracting this ratio from 100%.

Default, Netting And Close-Out (B)

- Netting affects the dynamics of OTC derivative markets. Suppose an institution wants to trade out of a position. Executing an offsetting position with another market participant will remove the market risk as required, but will leave counterparty risk with respect to the original and new counterparties. A counterparty knowing that an institution is heavily incentivized to trade out of the position with them may offer unfavorable terms to extract the maximum financial gain. The institution can either accept these unfavorable terms or transact with another counterparty and accept the resulting counterparty risk.

- The above point also applies while establishing multiple positions with different risk exposures. Suppose an institution requires both interest rate and foreign exchange hedges. Since these transactions are imperfectly correlated then by executing the hedges with the same counterparty, overall counterparty risk is reduced, and the institution may obtain more favourable terms. However, this creates an incentive to transact repeatedly with the same counterparty, leading to potential concentration risk.

- An additional implication of netting is that it can change the way market participants react to perceptions of increasing risk of a particular counterparty. If credit exposures were driven by gross positions, then all those trading with the troubled counterparty would have strong incentives to attempt to terminate existing positions and stop any new trading. Such actions would be likely to result in even more financial distress for the troubled counterparty. With netting, an institution will be far less worried if there is no current exposure (MTM is negative). While they will be concerned about potential future exposure and may require collateral, netting reduces the concern when a counterparty is in distress, which may in turn reduce systemic risk.

- The benefits from netting are under threat from the drive towards mandatory clearing of OTC derivatives since clearable transactions will be removed from the portfolio (and cleared at one or more central counterparties), thereby removing potential netting benefits from the residual bilateral portfolio.

Multilateral Netting And Trade Compression: Overview

- Typical ISDA netting agreements by their nature operate bilaterally between just two counterparties. Trade compression can go further and achieve multilateral netting benefits via the cooperation of multiple counterparties. Compression aims to minimize the gross notional of positions in the market. Even though it cannot change the market risk profile, it does potentially reduce the following –

- counterparty credit risk via reducing the overall exposure to multiple counterparties;

- operational costs by reducing the number of transactions;

- regulatory capital for banks not using advanced models where capital is partially driven by gross notional;

- regulatory capital for banks with advanced model approval where the margin period of risk may otherwise need to be increased;

- other components such as the leverage ratio since Basel III bases this partially on gross notional; and

- legal uncertainty around netting since offsetting transactions are replaced with a net equivalent transaction.

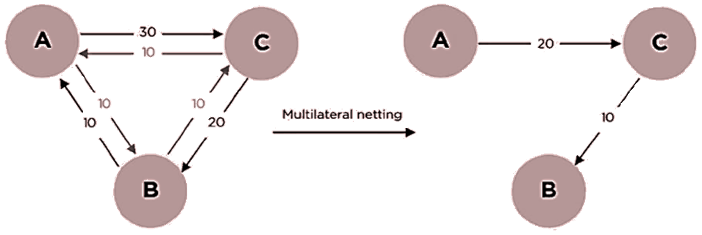

Multilateral Netting

- Suppose that party A has an exposure to party B, whilst B has exposure to a third party C that in turn has exposure to the original party A. Even using bilateral netting, all three parties have exposure (A has exposure to B, B to C and C to A). Some sort of trilateral (and by extension multilateral) netting between the three (or more) parties would allow the exposures to be netted further as illustrated in this figure.

Illustration of the potential exposure reduction offered by multilateral netting. The deep black and grey (lighter tone) exposures indicate positions in contractually identical (and therefore fungible) transactions, differing only in notional amount. The exposures in grey are removed completely, while those in deep black are reduced by ten units.

Bilateral Compression Services

- Initiatives such as TriOptima’s TriReduce service provides compression services covering major OTC derivatives products such as interest rate swaps (in major currencies),credit default swaps (CDS) on single-name, indices and tranches and energy swaps across around 200 members. This has helped to reduce exposures in OTC derivatives markets, especially in credit derivatives.

- Compression has developed since OTC derivatives portfolios grow significantly through time but contain redundancies due to the nature of trading (e.g. with respect to unwinds). This suggests that the transactions can be reduced in terms of number and gross notional without changing the overall risk profile. This will reduce operational costs and also minimize counterparty risk. It may also reduce systemic risk by lowering the number of contracts that need to be replaced in a counterparty default scenario.

- Compression is subject to diminishing marginal returns over time as the maximum multilateral netting is achieved. It also relies to some degree on counterparties being readily interchangeable, which implies they need to have comparable credit quality.

- A typical compression cycle will start with participants submitting their relevant transactions, which are matched according to the counterparty and cross-referenced against a trade-reporting warehouse. An optimal overall solution may involve positions between pairs of counterparties increasing or changing sign. For this and other reasons, participants can specify constraints such as the total exposure to a given counterparty, which may be related to internal credit limits of a participant. Participants must also specify tolerances since small changes in MTM valuations and risk profile can increase the extent of the compression possible. Based on trade population and tolerances, changes are determined based on redundancies in the multilateral trade population. Once the process is finished, all changes are legally binding.

- Compression services are also complimentary to central clearing as reducing the total notional and number of contracts cleared will be operationally more efficient and reduce complexity in close-out positions in case of a clearing member default. However, since trades are generally cleared quickly after being executed, trade compression process must be done at the CCP level.

- In future, development of more advanced compression services may be important to optimize the costs of transacting OTC derivatives. Compressing across both bilateral and central cleared products and using metrics like xVA instead of gross notional may be important.

The Need For Standardization

- Trade compression by its nature requires standard contracts. OTC derivatives that do not fit the standard product templates cannot be compressed. An example of producing standardization of this type is the CDS market. After the global financial crisis, large banks together with ISDA made swift progress in standardizing CDS contracts in terms of coupons and maturity. CDS contracts now trade with both fixed premiums and upfront payments, and scheduled termination dates of 20th March, 20th June, 20th September or 20th December. This means that positions can be bucketed according to underlying reference entity (single name or index) and maturity, but without any other differences (such as the previous standard where coupons and maturity dates would differ).

- Standardization of contracts to help compression is not always possible. For example, interest rate swaps typically trade at par via a variable fixed rate. In such cases, compression is less easy and methods such as “coupon blending” are being developed where swaps with the same maturity but different coupon rates can be combined.

Default, Netting And Close-Out-Examples

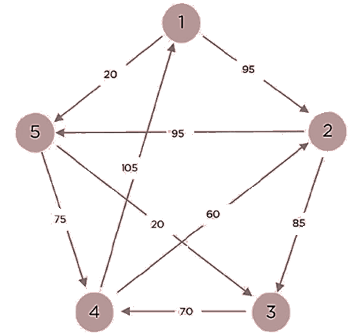

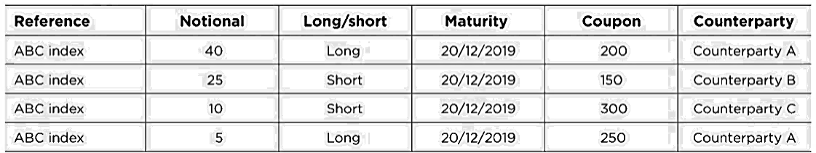

- Consider the example “market” represented by this figure. This shows position sizes between different counterparties in certain fungible (interchangeable) products. The total gross notional between counterparties is 1250.

- The aim of compression is to reduce the gross notional in this figure without changing the net position of any counterparty. But this is a subjective process for a number of reasons.

- Firstly, it is not clear what should be minimized. An obvious choice may be the total notional, although this would not penalize large positions or the total number of non-zero positions. Alternative choices could be to use the squared notional or the total number of positions, which would reduce large exposure and interconnectedness respectively.

- Secondly, there may need to be constraints applied to the optimization, such as the size of positions with single counterparties. In this example, there is no transaction between counterparties 1 and 3. It may be that one or both of them would like to impose this as a constraint.

Illustration of a simple “market” made up of positions in fungible (interchangeable) contracts

- Many different algorithms could be used to optimize the market above and commercial applications have tended to follow relatively simple approaches. The example below, for a very small market, will provide some insight on how they work in practice.

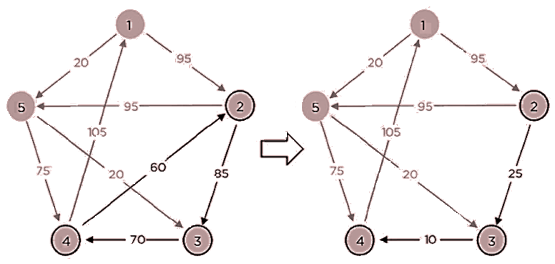

- One obvious method to reduce the total notional is to look for opportunities for netting within rings in the market. A trilateral possibility occurs between counterparties 2, 3 and 4 (as shown in this figure) where notionals of 60, 70 and 85 occur in a ring and can therefore be reduced by the smallest amount (assuming positions cannot be reversed) of 60. This leads to the total notional of the compressed system being reduced to 890 (from 1250) on the right-hand side of this figure.

Illustration of using trilateral netting between counterparties 2, 3 and 4 to reduce the overall notional of the system shown in the previous example “Market”

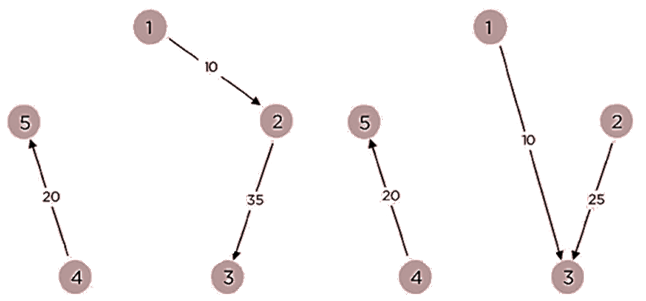

- Continuing a process such as the previous one could lead to a number of possible solutions, two of which are shown in this figure. The solution on the left-hand side has reversed the exposure between counterparties 4 and 5, while on the right-hand side there is a transaction between counterparties 1 and 3 where none existed previously.

- The latter solution has a lower total notional of 110 (compared to 130 for the former), however, this also illustrates that constraints imposed by counterparties (for example, 1 and 3 not wanting exposure to one another) will weaken the impact of compression.

Illustration of two possible final results of compressing the original market leading to total notionals of 130 (left-hand side) and 110 (right-hand side).

- A simple example of the potential result of a CDS compression exercise for one market participant is given in this table. Here, the net long position resulting from transactions with three counterparties is reduced to a single identical long position with one of the counterparties. In this example, the coupons are assumed different and the weighted coupon is maintained. This is not typically the case in the CDS market, but may be a problem for compression of other products such as interest rate swaps, which do not trade with up-front premiums.

Simple Illustration of Trade Compression for Single Name CDS Contracts. A Party has Three Contracts on the same Reference Credit and with Identical Maturities but Transacted with Different Counterparties. It is Beneficial to “Compress” the Three into a Net Contract, Which Represents the Total Notional of the Long and Short Positions. This may Naturally be with Counterparty A as a Reduction of the Initial Transaction. The Coupon of the New Contract is the Weighted Average of the Three Original Ones

Termination Features And Resets

- Long-dated derivatives have the problem that, whilst the current exposure might be relatively small and manageable, the exposure years from now could have easily increased to a relatively large, unmanageable level. An obvious way to mitigate this problem is to have a contractual feature in the transaction that permits action to reduce a high exposure. This is the role of termination features such as the following –

- Walkaway Features

- Termination Events

- Reset Agreements

Walkaway Features

- Some OTC derivatives were historically documented with “walkaway” or “tear-up” features, which are no longer common. Such a clause effectively allows an institution to cancel transactions in the event that their counterparty defaults. They would clearly only choose to do this in case they were in debt to the counterparty.

- While a feature such as this does not reduce credit exposure, it does allow a surviving party to benefit from ceasing payments and not being obliged to settle amounts owed to a counterparty. These types of agreements are not now part of standardized ISDA documentation, and have only been used sometimes since 1992. Walkaway features do not mitigate counterparty risk per se, but they do result in potential gains that offset the risk of potential losses.

- Walkaway agreements were seen in the Drexel Burnham Lambert (DBL) bankruptcy of 1990. Interestingly, in this case counterparties of DBL decided not to walk away and chose to settle net amounts owed. This was largely due to relatively small gains compared with the potential legal cost of having to defend the validity of the walkaway agreements or the reputational cost of being seen as taking advantage of the DBL default.

- Even without an explicit walkaway agreement, an institution can still attempt to gain in the event of a counterparty default by not closing out contracts that are out-of- the-money to them but ceasing underlying payments.

- A case between Enron Australia (Enron) and TXU Electricity (TXU) involved a number of electricity swaps that were against TXU when Enron went into liquidation in early 2002. Although the swaps were not transacted with a walkaway feature, ISDA documentation supported TXU avoiding paying the MTM owed to Enron (A$3.3 million) by not terminating the transaction (close-out) but ceasing payments to their defaulted counterparty. The Enron liquidator went to court to try to force TXU to settle the swaps but the Court ruled in favor of TXU that they would not have to pay the owed amount until the individual transactions expired (i.e. the obligation to pay was not cancelled but it was postponed).

- Some Lehman Brothers counterparties also chose (like TXU) not to close-out swaps and stop making contractual payments (as their ISDA Master Agreements seemed to support).

- Walkaway feature can lead to the creation of moral hazard, since an institution is potentially given the incentive to contribute to their counterparty’s default due to the financial gain they can make.

Termination Events

- Another important aspect of the ISDA Master Agreement is an additional termination event (ATE), which allows a party to terminate OTC derivative transactions in certain situations. The most common ATE is in relation to a rating downgrade of one or both counterparties (for example, below investment grade). For unrated parties like hedge funds, other metrics such as market capitalization, net asset value or key man departure may be used.

- ATEs are designed to mitigate against counterparty risk by allowing a party to terminate transactions or apply other risk-reducing actions when their counterparty’s credit quality is deteriorating. This may be considered particularly useful when trading with a relatively good credit quality counterparty and/or long-maturity transactions. Over such a time horizon, there is ample time for both the MTM of the transaction to become significantly positive and for the credit quality of the counterparty to decline. If the ATE is exercised then the party can terminate the transactions at their current replacement value. ATEs may not always lead to a termination of transactions and alternatively the affected party may be required to post (additional) collateral, or provide third party credit protection.

- As an alternative to ATEs that apply to all transactions under a given ISDA Master Agreement, individual transactions may reference similar terms which have often been termed “break clauses” or “mutual puts”. It may be considered advantageous to attach such a clause to a long dated transaction (e.g. ten years or above), which carries significant counterparty risk over its lifetime. For example, a 15-year swap might have a mutual put in year five and every two years thereafter. Such break clauses may be mandatory, optional or trigger-based, and may apply to one or both parties in a transaction.

- Recent years have highlighted the potential dangers of ATEs and other break clauses, in particular:

- Risk-reducing benefit. Whilst an idiosyncratic rating downgrade of a given counterparty may be a situation that can be mitigated against, a systematic deterioration in credit quality is much harder to nullify. Such systematic deteriorations are more likely for larger financial institutions, as observed in the global financial crisis.

- Weaknesses in credit ratings. Breaks clearly need to be exercised early before the counterparty’s credit quality declines significantly and/or exposure increases substantially. Exercising them at the “last minute” is unlikely to be useful due to systemic risk problems. Ratings are well-known to be somewhat unreactive as dynamic measures of credit quality. By the time the rating agency has downgraded the counterparty, financial difficulties will be too acute for the clause to be effective. This was seen clearly with respect to counterparties like monoline insurers in the global financial crisis. Under the Basel III rules for capital allocation, no positive benefit for ratings-based triggers is allowed.

- Furthermore, ratings have in many circumstances been shown to be extremely slow in reacting to negative credit information, leading to the following problems:

- Cliff-edge effects. The fact that many counterparties could have similar clauses may cause cliff-edge effects where a relatively small event such as a single-notch rating downgrade may cause a dramatic consequence as multiple counterparties all attempt to terminate transactions or demand other risk mitigating actions. The near-failure of AIG is a good example of this.

- Determination of valuation in the event o f a termination. As discussed with respect to the definition of the close-out amount earlier, the market price used for termination is difficult and non-subjective to define.

- Relationship issues. Exercising break clauses may harm the relationship with a counterparty irrevocably and would therefore often not be used, even when contractually available. Clients do not generally expect break clauses to be exercised and banks, for relationship reasons, have historically avoided exercising these. Although banks have used break clauses more in recent years, in hindsight many have been no more than gimmicks. This is part of a moral hazard problem, where front-office personnel may use the presence of a break clause to get a transaction executed but then later argue against the exercise of the break to avoid a negative impact on the client relationship. Banks should have clear and consistent policies over the exercise of optional break clauses and the benefit they assign to them from a risk reduction point of view. There is typically a lack of internal clarity around who in a bank is empowered to exercise an ATE or other type of break clause.

- Modelling difficulty. Breaks are difficult to model since it is hard to determine the dynamics of rating changes in relation to potential later default events and the probability that a break would be exercised. Unlike default probability, rating transitions probabilities cannot be implied from market data. This means that historical data must be used, which is scarce and limited to some broad classification. This also means that there is no obvious means to hedge such triggers. One uncommon exception is where the break is mandatory where the model may simply assume it will occur with 100% probability.

- Although traditionally popular with credit and sales departments in banks, break clauses are seen by xVA desks as adding significant complexity and potentially very limited benefit. They are generally becoming less common, either being modified to permit cures such as posting of additional collateral or removed completely. Using other measures of credit quality such as CDS spreads may resolve some (but not all) of the problems of traditional breaks mentioned above and is not currently practical due to the illiquidity of the CDS market.

- Before the financial crisis, break clauses were typically required by banks trading with certain (often uncollateralized) counterparties. More recently, it has become common for counterparties such as asset managers and pension funds to require break clauses linked to banks’ own credit ratings due to the unprecedented credit quality problems within the banking sector during the global financial crisis. These breaks are also problematic since declines in banks’ ratings and credit quality are likely to be linked to significant systemic problems generally. This means that finding a replacement counterparty for a given transaction may not be easy. Additionally, in recent times the liquidity coverage ratio has had an impact of such clauses as regulation has required banks to hold a liquidity buffer according to a worst case change in their credit rating.

Reset Agreements

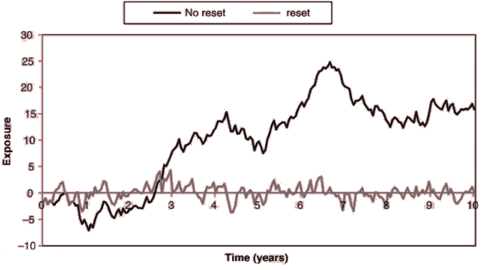

- A reset agreement is a different type of clause which avoids a transaction becoming strongly in-the-money (to either party) by means of adjusting product-specific parameters that reset the transaction to be more at-the-money. Reset dates may coincide with payment dates or be triggered by the breach of some market value. For example, in a resettable cross-currency swap, the MTM on the swap (which is mainly driven by FX movements on the final exchange of notional) is exchanged at each reset time in cash. In addition, the FX rate is reset to (typically) the prevailing spot rate. The reset means that the notional on one leg of the swap will change. Such a reset is similar to the impact of closing out the transaction and executing a replacement transaction at market rates, and consequently reduces the exposure. An example of the impact of such a reset is shown in this figure. It can also be seen as a weaker form of collateralization.

Illustration of the impact of reset features on the exposure of a long-dated cross-currency swap. Resets are assumed to occur quarterly